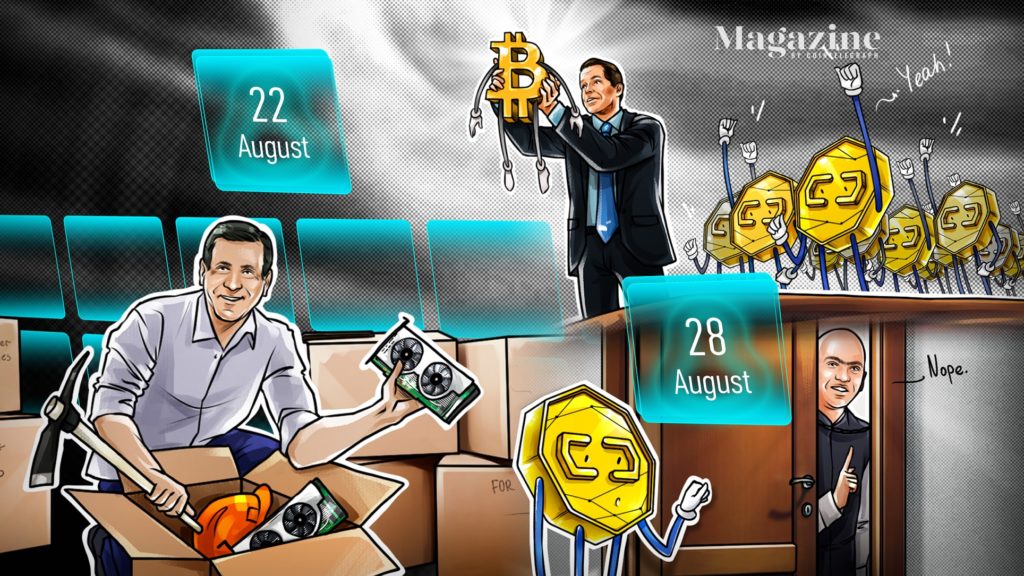

U.S. Congress submits 18 crypto bills in 2021, Visa buys $150K CryptoPunk, MicroStrategy snaps up more BTC: Hodler’s Digest, Aug. 22-28

Coming every Saturday, Hodlers Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more a week on Cointelegraph in one link.

Top Stories This Week

Congress has put forward 18 bills on digital assets in 2021 so far

The U.S. Congress has been ramping up its efforts to provide a regulatory framework for crypto in 2021 and has put forward 18 bills concerning digital assets and blockchain tech so far this year.

According to an Aug. 22 analysis from former Federal Deposit Insurance Corporation regulator Jason Brett, the current 117th Congress differs from its predecessor in that it has been focusing on regulation concerning decentralized assets as opposed to private stablecoins.

It was also reported this week that the contentious $1 trillion infrastructure bill will see a vote in the House of Representatives by Sept. 27 without any amendments to the controversial crypto tax provisions.

Visa invests $150,000 in NFT CryptoPunk asset

This week Visa, Visa spent $150,000 on a tokenized JPEG of a pixel art punk, better known as a CryptoPunk NFT. The firm announced the news in an Aug. 23 blog post, with Cuy Sheffield, the head of crypto at Visa, teasing that the firm may be looking at a prolonged stay in the sector.

To help our clients and partners participate, we need a first-hand understanding of the infrastructure requirements for a global brand to purchase, store and leverage an NFT, he said.

Visa purchased CryptoPunk 7610 a female figure with a mohawk, green clown makeup eyes and lipstick. Obtaining an understanding of the infrastructure requirements in purchasing an NFT mustn’t have taken long, as all you need to do is buy it and store it in your wallet. Its not rocket science.

Budweiser also joined in the action by purchasing a fan art NFT for 8 Ether (ETH), worth roughly $25,000. The NFT depicted a Budweiser-branded rocket that would take five minutes to whip up on Adobe Illustrator. The beer producer also spent 30 ETH, or $94,000, on the domain name Beer.eth through Ethereum Name Service on OpenSea.

PayPal launches crypto services for UK customers

Global payments provider PayPal announced the rollout of its crypto services for customers in the United Kingdom this week.

PayPal first launched its crypto services less than a year ago, and this is the first time it has expanded crypto support beyond U.S. shores.

The firm will initially allow customers to buy, sell and hold crypto assets including Bitcoin (BTC), Ether, Litecoin (LTC) and Bitcoin Cash (BCH). However, crypto transactions for PayPal business accounts arent supported yet.

MicroStrategy splashes $177M on Bitcoin, now holds almost 109,000 BTC

MicroStrategy, led by Bitcoin apostle Michael Saylor, has snapped up another $177 million worth of digital gold. The latest purchase takes the firms tally up to 108,992 BTC, which cost a mere $2,918 billion overall.

The average purchasing price for its BTC sits at approximately $26,769 per coin. With the price of BTC sitting at $47,584 at the time of writing, MicroStrategys holdings are valued at $5.1 billion.

It is a foregone conclusion that Saylor is all in on BTC at this stage. However, it is yet to be seen if he will respond to crypto skeptic Peter Schiffs call out for a debate. Schiff faced off against Anthony Scaramucci this week over whether gold or BTC is a better store of value. After he won, he stated in jest:

I just gotta say one thing: Michael Saylor, stop ducking me, I know youre out there.

Binance denies allegations of market manipulation

Major crypto exchange Binance came out swinging this week as it pushed back against allegations of market manipulation and trading against its users.

The firm is currently facing regulatory scrutiny and, in an Aug. 23 Twitter thread, Binance seemingly laid the blame of assertions of market manipulation on publications spreading FUD, along with people impersonating Binance employees.

The firm stated that, while it works on its compliance targets with regulators, it expects fewer FUD-peddlers and individuals with malicious intent, and went on to warn:

Binance reserves the right to take legal action to protect its interests and welcomes responsible whistle-blowing that protects the trust of our community.

Winners and Losers

At the end of the week, Bitcoin is at $48,373, Ether at $3,233 and XRP at $1.14. The total market cap is at $2.08 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Tezos (XTZ) at 46.33%, Avalanche (AVAX) at 33.86% and Celo (CELO) at 31.97%.

The top three altcoin losers of the week are Audius (AUDIO) at -21.08%, XinFin Network (XDC) at -13.99% and SushiSwap (SUSHI) at -12.76%.

For more info on crypto prices, make sure to read Cointelegraphs market analysis.

Most Memorable Quotations

As long as the statute says that software developers, miners, stakers must do the impossible, there is no lawyer who would advise them to risk operating in violation of laws whose penalties for non-compliance would easily bankrupt them.

Lawrence Zlatkin, Coinbase global vice president of tax

In the last year, weve seen a significant shift in how the global financial ecosystem is thinking about new business models fueled by digital assets, and how this is playing a meaningful role in financial infrastructure.

Linda Pawczuk, principal at Deloitte Consulting

We will want to wait for all the regulatory things. Of course, crypto is an area which is extremely interesting, and is the biggest buzzword and is doing exceptionally well. But we would want to understand more on the regulation side.

Manu Jain, managing director of Xiaomi India

A trading platform that offers derivatives on digital assets to U.S. persons without registering, or in violation of CFTC trading rules, is subject to the CFTCs enforcement authority.

Dawn Stump, commissioner at the U.S. Commodity Futures Trading Commission

When you have a good crypto wallet like Novi will be, you also have to think about how to help consumers support NFTs.

David Marcus, head of Facebook Financial and co-creator of Diem

Be wary of investment opportunities with low risk and high returns. If something sounds too good to be true, it probably is.

Delia Rickard, deputy chair of the Australian Competition and Consumer Commission

Binance has never traded against our users nor manipulated the market, and we never will.

With our CryptoPunk purchase, were jumping in feet first. This is just the beginning of our work in this space.

Cuy Sheffield, head of crypto at Visa

I think this cryptocurrency revolution and Bitcoin specifically, because of its scarcity, is going to transcend gold. Its more portable, its impregnable in terms of the transaction over the blockchain […] and its being adopted quite rapidly.

Anthony Scaramucci, Skybridge founder

Prediction of the Week

Bitcoin bullish cross on weekly chart paints $225K BTC price target if history repeats

Bitcoin regained the $50,000 price level this week, although the asset subsequently fell several thousand dollars as part of a price correction, fluctuating between $45,000 and $50,000 for most of the week.

During the month of August, the moving average convergence/divergence (MACD) indicator on Bitcoins weekly price chart formed and continued through a cross of the indicators two lines, and jumped to green on its histogram (the bar part at the bottom of the indicator).

What does it mean? Well, nothing is certain, but according to reporting from Cointelegraphs William Suberg, the last time Bitcoins MACD indicator acted similarly (last fall), the assets price grew by more than five times in value in the following half dozen months. BTC could potentially rise above $200,000 if things play out comparably, according to Suberg.

FUD of the Week

Google bans 8 deceptive crypto apps from Play Store

Google, the Silicon Valley-based tech overlords, took down eight fraudulent crypto apps from its Google Play Store this week.

Fraudulent crypto-themed mobile apps have been popping up more frequently over the past 12 months, and they usually operate under the false pretext of offering cloud mining services.

According to a recent report from Trend Micro, the apps were charging around $15 a month for their fake services and extra for increased mining capabilities all while duping users into watching paid ads.

The reportedly fake crypto apps included mining services such as BitFunds, Bitcoin Miner, Daily Bitcoin Rewards, Crypto Holic and MineBit Pro, to name a few.

Poll shows Brits concerned over the prospect of a digital pound

According to a survey conducted by Redfield & Wilton Strategies on behalf of Politico, 30% of British adults hold concerns over a Bank of England-issued central bank digital currency, or CBDC.

For some reason, the notion of having a programmable government-backed CBDC that can track all of their spending habits doesnt sound appealing to them. If they think thats bad, just wait until they hear about the insatiable appetite for personal data that Apple, Google or Facebook has.

There were 2,500 British adults surveyed in the study during early August, with 24% believing that it could be beneficial, while 46% were undecided.

Coinbase users angry with customer support after funds disappear from accounts

Top U.S. crypto exchange Coinbase was facing backlash this week for terrible customer service in relation to users reporting hacks and being drained of funds.

According to an Aug. 24 investigation from CNBC, thousands of disgruntled customers across the U.S. have lodged complaints against the company, and are unhappy with the lack of response from Coinbase when dealing with hacks and stolen funds.

Interviews with Coinbase customers around the country and a review of thousands of complaints reveal a pattern of account takeovers, where users see money suddenly vanish from their account, followed by poor customer service from Coinbase that made those users feel left hanging and angry, CNBC stated.

Best Cointelegraph Features

Blockchain is as revolutionary as electricity: Big Ideas with Jason Potts

“This is completing the revolution that was started with the internet.”

London’s impact: Ethereum 2.0’s staking contract becomes largest ETH holder

The aftereffects of the London upgrade begin to emerge as the Eth2 staking contract becomes the single largest Ether holder.

The new episode of crypto regulation: The Empire Strikes Back

A decentralized exchange reckoning is coming and its bigger than the infrastructure bill thus, the DeFi community must be ready.