Stock-to-Flow Creator Says ‘$288K Still in Play,’ Mike McGlone Sees an ‘Ace up Bitcoin’s Sleeve’

The popular Twitter account and creator of the bitcoin stock-to-flow (S2F) price model explained that “$288K [is] still in play.” Meanwhile, data from the exchange Deribit shows there’s 425 bitcoin call options with a strike price of $200K set for December 31, 2021.

Plan B Says: ‘$288K Still in Play’

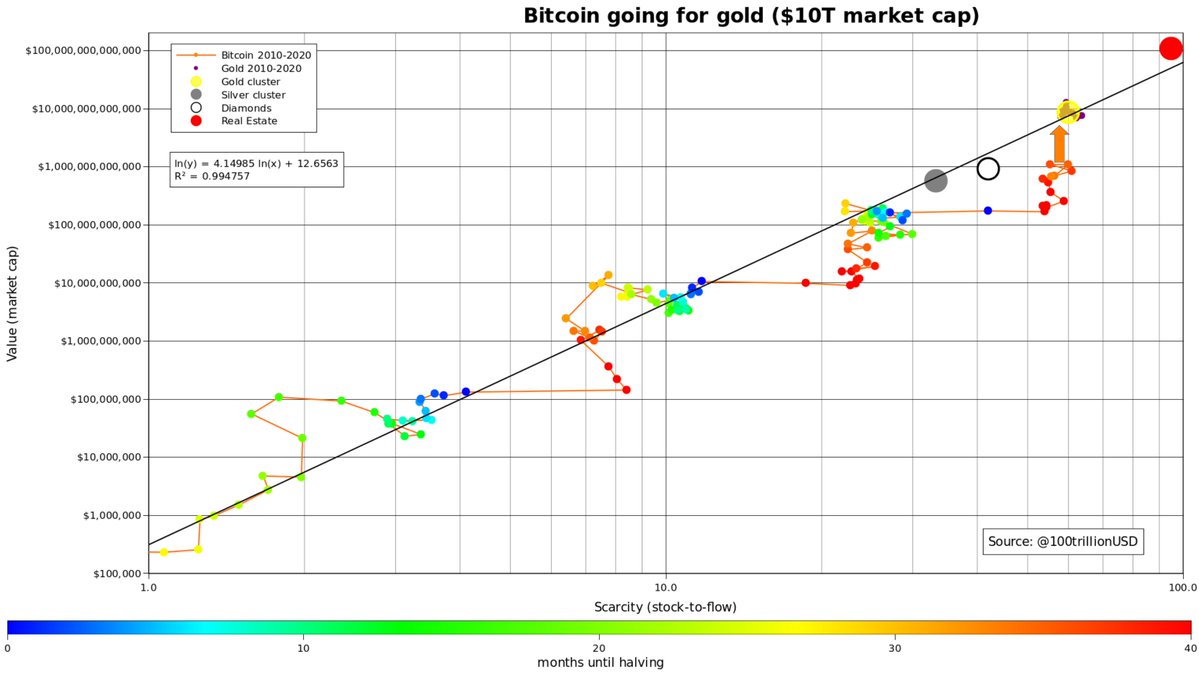

On June 12, 2021, while bitcoin (BTC) prices have been hovering just above the $35K zone, the popular Twitter account Plan B (@100trillionusd) told his 553,000 followers that six-figure bitcoin prices are still intact. Plan B is a pseudonym and he published the stock-to-flow (S2F) price model in March 2019. He also updated the S2F model to another version called the stock-to-flow cross-asset (S2FX) model.

Twelve days ago, Bitcoin.com News reported on how Plan B said his S2FX model was “intact.” Plan B has always shown confidence in his model but when he last tweeted about the S2FX being intact, he invoked a poll on Twitter. The pseudonym asked his followers if they thought the S2F model would break or will it turn out to be an excellent buy signal. When the poll completed more than 53% of the 31,824 votes said it was a “buy signal.”

Plan B’s statements on Saturday still show confidence in the model and even six-figure price targets. “$288K still in play,” Plan B said on Twitter. “It would really surprise me if bitcoin would not touch the black S2FX model line this phase. Regardless of current volatility, yellow green and blue dots will be (much) higher than red orange dots,” the analyst added.

A Twitter account responded to Plan B’s tweet on Saturday and asked: “What gives this confidence given the large downwards deviation from the model at the moment? Is it onchain analytics?”

Plan B responded and noted that things look awfully similar to 2013 and 2017. Plan B noted:

Deviation is not much different from 2013 (S2F ~10) or 2017 (S2F ~25), just the usual inertia after a halving.

Deribit Call Options With a Strike Price of $200K for December 31, Bloomberg Strategist McGlone Sees an Ace up Bitcoin’s Sleeve

Plan B is not the only person expecting six-figure prices as data from Deribit’s call options records show more than 400 contracts with an expiry set for the last day of 2021 for a price above $200K per BTC.

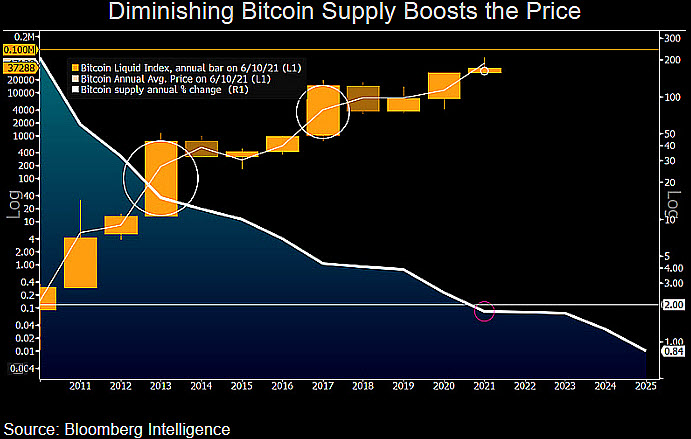

Senior commodity strategist at Bloomberg Intelligence, Mike McGlone, also spoke about bitcoin’s scarcity and touched upon the next halving on Saturday.

“Bitcoin $100,000 Has Bullish Ace Up Its Sleeve: Declining Supply — This year follows a cut in Bitcoin supply, making the price more likely to appreciate if past patterns hold,” McGlone tweeted, while also sharing a chart of the diminishing BTC supply. The diminishing bitcoin supply is a stark contrast to the $8 trillion recorded on the Federal Reserve’s balance sheet for the first time in history on June 10, 2021.

Meanwhile, some skeptics as usual disagree with people like Plan B or Mike McGlone as one person responded to McGlone’s optimistic outlook. “Don’t marry the trade, it’s in a bear market,” the individual replied to McGlone on Twitter.

What do you think about the six-figure prices “still in play” for bitcoin according to Plan B or the 400+ contracts betting the price will be $200K by the year’s end? Let us know what you think about this subject in the comments section below.