Ripple Price Prediction: XRP/USD Recovers Above $1.60 Level as Bulls Attempt to Regain Momentum

XRP Price Prediction – April 30

The Ripple (XRP) renews the bullish trend after testing the support level of $1.36.

XRP/USD Market

Key Levels:

Resistance levels: $1.85, $1.95, $2.05

Support levels: $1.10, $1.00, $1.90

XRP/USD is currently trading above the 9-day and 21-day moving averages. The fourth-largest cryptocurrency by market capitalization has on several occasions been able to remain above the $1.30 resistance level. Meanwhile, a monthly high traded at $1.98 marked the end of the bullish action towards the south and paved the way for losses under $0.90.

What is the Next Direction for Ripple?

XRP/USD commences an intriguing recovery towards a $1.50 resistance level. The initial break above the moving averages boosted the price farther up. The Ripple (XRP) hit a daily high of $1.65 before retreating back to where it is currently trading. Meanwhile, from above, more hurdles may come into play towards the upper boundary of the channel and of course, the nearest resistance level is located at $1.65.

However, the short-term trend remains in the hands of the bulls supported by the technical indicator where the RSI (14) is crossing above 62-level, building on the consistent recovery from the downside recorded on April 25. Ripple’s bullish scenario is emphasized by the RSI (14) indicator as it extends the action towards the overbought condition.

Nevertheless, a break above $1.85 and $1.95 resistance levels may most likely push the coin above the potential $2.05 resistance level while a break below the moving averages may lead to the supports at $1.10, $1.00, and $0.90 respectively.

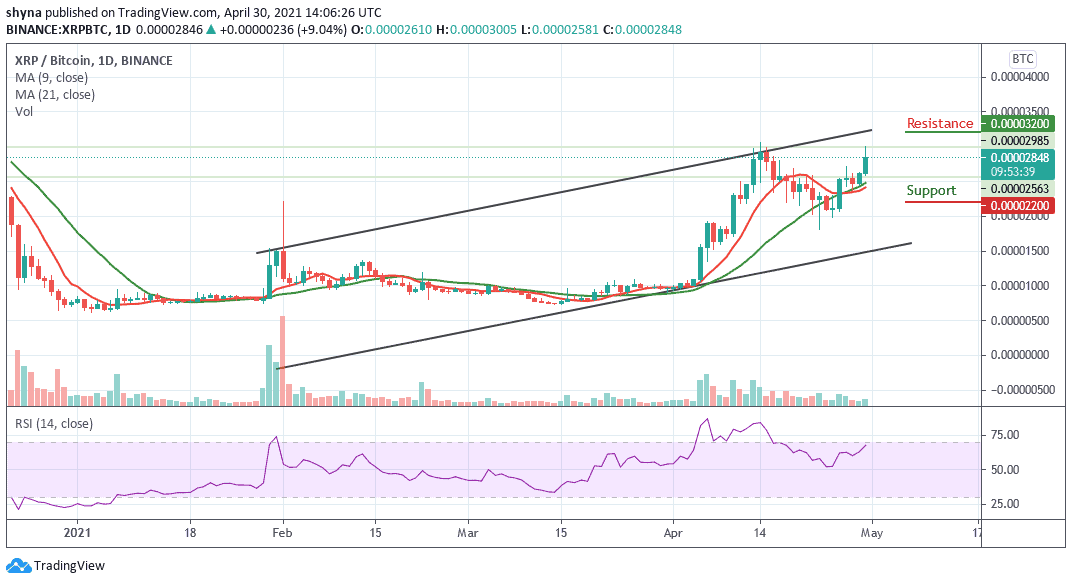

Against Bitcoin, the pair is consolidating to the upside hovering above the 9-day and 21-day moving averages. Meanwhile, the bulls are now pushing the price towards the upper boundary of the channel; breaking above the channel may likely take it to the resistance level of 3200 SAT and above.

On the other hand, if the coin decides to follow the downtrend, sliding below the moving averages may likely drag to the critical support at 2200 SAT and below. Meanwhile, the technical indicator RSI (14) is moving into the overbought condition, suggesting additional bullish signals.