FTX seeks to claw back $460M from Bankman-Fried-backed VC firm

While the funds represent a small portion of FTX’s overall asset shortfall, the settlement means the firms can avoid a costly legal battle.

Bankrupt crypto exchange FTX is seeking to recover $460 million of allegedly misappropriated customer funds from venture capital firm Modulo Capital, which received a sizeable investment from Alameda Research last year.

As previously reported, Alameda Research — FTX’s sister trading firm — was understood to have invested around $400 million in Modulo in 2022, in one of the biggest investments undertaken by FTX under SamBankman-Fried’s leadership.

In a March 22 filing, FTX claimed the investment from Alameda Research was at the direction of Bankman-Fried, with Alameda investing $475 million in Modulo in a series of transfers beginning in May 2022.

On June 16, Alameda entered into a limited partnership agreement with Modulo, according to the filing, which resulted in Alameda transferring the aforementioned funds to Modulo in exchange for ownership of 20% of Modulo’s Class A shares.

In bankruptcy proceedings, payments made to entities prior to the bankruptcy filing may be eligible to be clawed back and redistributed to creditors. While the clawback period is 90 days for most unsecured creditors, it is one year for “insiders,” a term that includes general partners.

As per the settlement agreement, Modulo has agreed to repay $404 million in cash and will give up its claim to $56 million worth of assets held on FTX’s crypto exchange, representing nearly 97% of FTX’s initial investment.

FTX is settling with Modulo Capital for $460 million.

First big “clawback”. pic.twitter.com/JNHn2bhNLb

— FTX 2.0pium (FTX Creditor) (@AFTXcreditor) March 22, 2023

The settlement would also result in Alameda losing any claim to its Modulo shares.

Modulo Capital was founded in March 2022 by three former executives at Jane Street, a New York-based firm that once employed Bankman-Fried and former Alameda CEO Caroline Ellison.

Bankman-Fried is also reported to have been in a romantic relationship with one of its founders, Xiaoyun “Lily” Zhang, which some have theorized was the motivation behind his push to invest in the obscure VC firm.

Bankman-Fried’s girlfriend? Xiaoyun “Lily” Zhang, used to be romantically involved with Bankman-Fried, according to four people familiar with their relationship. her partner, Duncan Rheingans-Yoo, had only graduated from Harvard two years before SBF’s investment. That’s textbook

— 9:29 (@GuitarSunCat) January 25, 2023

The deal will still need to be confirmed by United States Bankruptcy Judge John Dorsey, with a motion hearing set for April 12.

Related: FTX debtors file lawsuit against exchange’s Bahamian arm on ownership of property

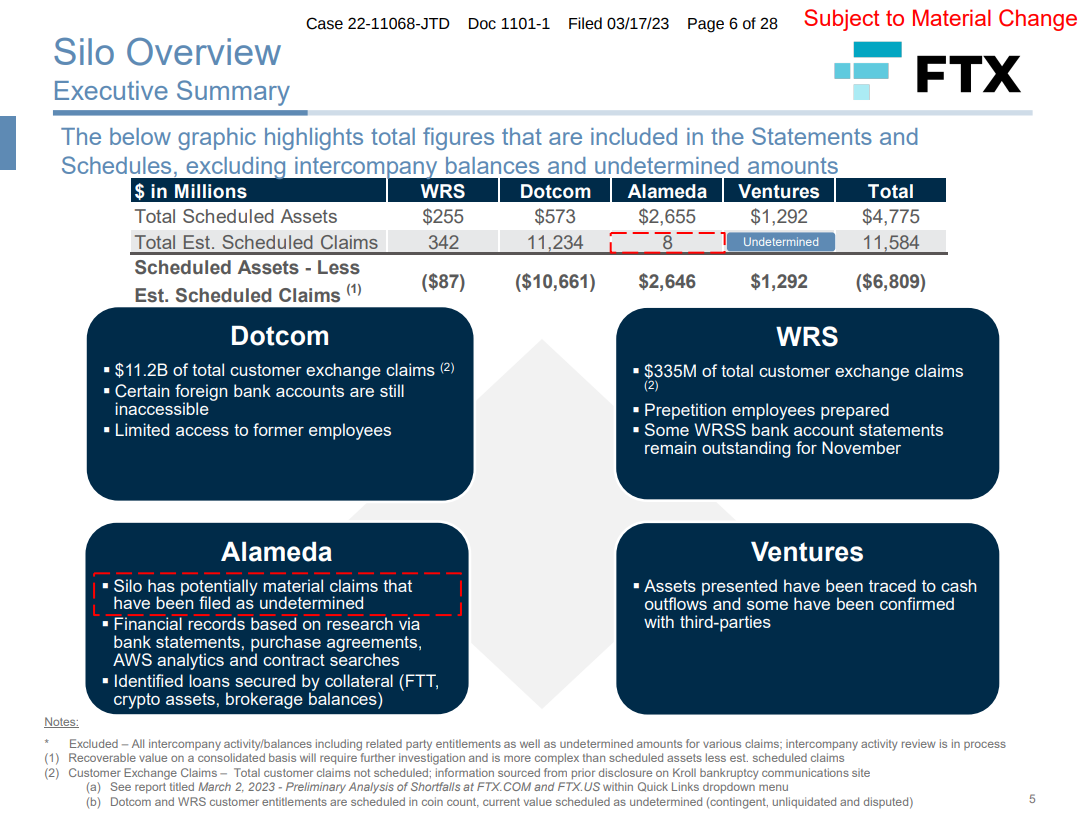

In its latest presentation to creditors on March 17, FTX noted claims against it surpassed $11 billion, compared to just $4.7 billion in assets for a total shortfall of nearly $7 billion, so while the $460 million settlement would be a huge win for creditors it still only represents less than 7% of the current shortfall.

Related: Best and worst countries for crypto taxes — plus crypto tax tips