Ethereum (ETH) Price: Retail Interest Hits Multi-Year Low As $2,000 Level Holds

TLDR

Retail sentiment toward Ethereum is at extreme lows according to Google Trends data

ETH is currently trading at $2,007, consolidating below key $2,300 resistance

Technical indicators show mixed signals with some analysts predicting a breakout while others expect a drop to $1,300

Potential catalysts include Ethereum ETF approval, staking, and the upcoming Pectra update

ETH must break through $2,040 resistance to prevent further decline toward $1,980 support

Ethereum (ETH) currently finds itself at a crucial point in the market as retail investor interest hits multi-year lows. The second-largest cryptocurrency by market cap trades at $2,007, showing price stagnation that has kept many smaller investors on the sidelines.

Google Trends data reveals retail interest in Ethereum sits well below its previous peaks in 2017 and 2021. Cryptocurrency analyst Mister Crypto points to this metric as evidence of “extremely low” retail sentiment toward ETH.

This lack of retail enthusiasm could present buying opportunities for institutional investors. Historically, periods of low retail interest have preceded accumulation phases by larger market participants positioning themselves before price surges.

Despite current price struggles, several analysts remain optimistic about Ethereum’s prospects. Crypto analyst Ted highlights potential catalysts that could spark a breakout, including the possible approval of an Ethereum exchange-traded fund (ETF) with staking features.

The upcoming Pectra update represents another development that could help ETH regain momentum. These fundamental improvements to the Ethereum network may attract renewed interest from investors looking for growth potential.

Technical Analysis

Analyst Crypto Patel supports this outlook, noting that ETH appears to be consolidating within an accumulation range. Based on historical price patterns and on-chain data, Patel expects a breakout after April with an ambitious long-term target of $10,000.

Technical analysis from Titan of Crypto reveals a bullish crossover on Ethereum’s weekly Stochastic RSI. This indicator has historically marked market bottoms, suggesting ETH might be nearing the end of its bearish cycle.

#Ethereum Showing Signs of Bottoming

The weekly Stochastic RSI bullish crossover in oversold territory has often signaled market bottoms for #ETH. pic.twitter.com/q62KmaRFqz

— Titan of Crypto (@Washigorira) March 26, 2025

Not all analysts share this positive outlook. Ali Martinez sees “no change in the outlook for Ethereum” and suggests ETH may still drop to around $1,300, representing the lower end of its current price range.

On-chain metrics present a more complex picture. The Market Value to Realized Value Z-score (MVRV-Z) indicates that ETH may be undervalued at current prices. This metric compares market value to realized value and typically signals potential accumulation zones.

For Ethereum to confirm a bullish reversal, it must overcome resistance at $2,300. A successful breakthrough could push ETH toward $3,000 in the near term, while failure might result in continued consolidation or further decline.

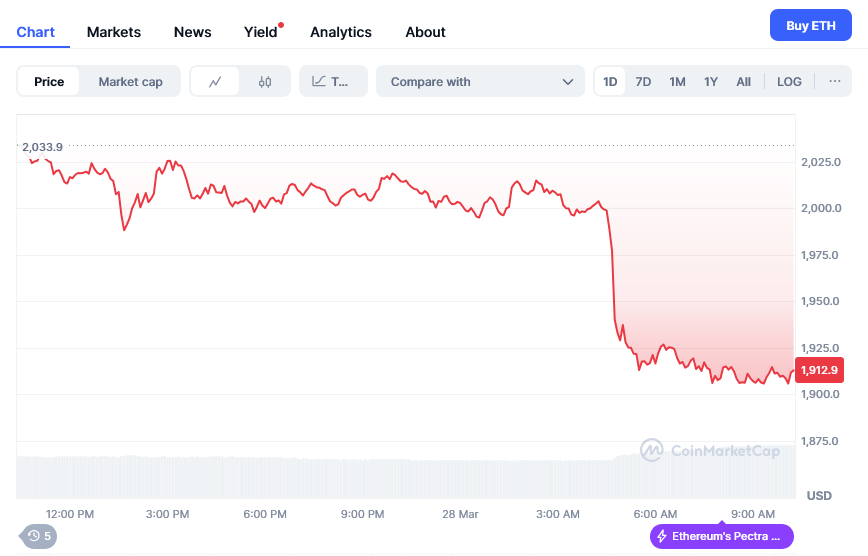

Short-term price action shows ETH struggling to maintain momentum above $2,020. The cryptocurrency faces immediate resistance around $2,040, with a bearish trend line visible on hourly charts.

Ethereum Price

If Ethereum fails to clear the $2,040 resistance, it risks another leg down. Initial support lies near $2,000, with stronger support established around $1,980. A break below this level could send ETH toward $1,880 or even $1,820.

The hourly MACD indicator shows weakening momentum in bearish territory. This technical signal, combined with an RSI below 50, suggests short-term pressure remains to the downside.

For a sustained recovery, Ethereum needs to break above $2,095 and then $2,150. Such a move would likely trigger additional buying, potentially pushing the price toward $2,250 or $2,320 in the coming weeks.

Ethereum’s current price action appears driven by a combination of weak retail sentiment and conflicting technical indicators. While some analysts point to undervaluation and potential catalysts, others see continued downside risk.

The post Ethereum (ETH) Price: Retail Interest Hits Multi-Year Low As $2,000 Level Holds appeared first on Blockonomi.