Ethereum Dips Below $1,000 on Three Arrows Selling, AVAX, CEL, SOL, Jun. 20

ETH

The price of Ethereum was hit this week with the coin dropping below the $1,000 level.

A 9% loss for the week was an improvement from sharper losses after Ethereum was rocked by another liquidity threat in the form of hedge fund Three Arrows Capital. The fund had to make margin calls and was dumping a staking ETH token after the company faced insolvency.

The fund was a big investor in Ethereum, Near Protocol and Avalanche. Those three projects will remain in focus this week as investors keep an eye on the 3AC issue. 3AC owned over $60k in staked Ethereum (stETH) and forced liquidation dragged Ethereum lower through the $1,000 level.

The fund has been said to own $560 million in the LUNA project before it collapsed and that is likely the cause of the latest problems and liquidity drive.

There are also threats to the larger cryptocurrency industry as 3AC also had loans from many companies and could default on those.

The price of Ethereum has rallied back from $950 to trade above $1,130. On the monthly chart in Ethereum, we can see that it has bounced at a support zone which marked a previous high. That will be an important level for ETH in the coming weeks in order to stop the rot.

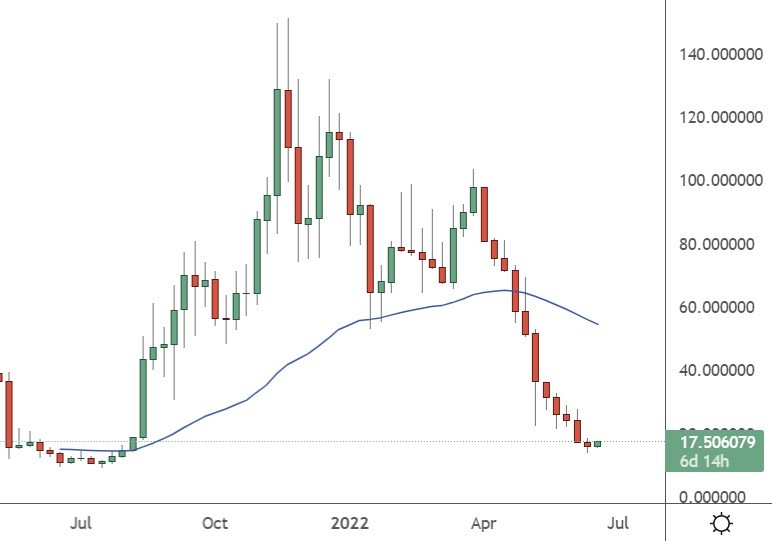

AVAX

Avalanche (AVAX) was also dragged into the Three Arrows Capital crisis with the project having to distance itself from the troubled fund.

Avalanche joined a group of projects that released statements to clarify 3AC’s involvement in their respective ecosystems. 3AC was said to have a stake in AVAX and selling pressure is possible if the company had to unwind some of its holdings.

Avalanche has lived up to its name with the price tumbling from highs near $140 last year to around $15. However, NFT trades on avalanche have shown an uptick in recent days. The total NFT trade volume reached $2.27 million on 14th June. This was the highest for AVAX NFT trade volume over the last month.

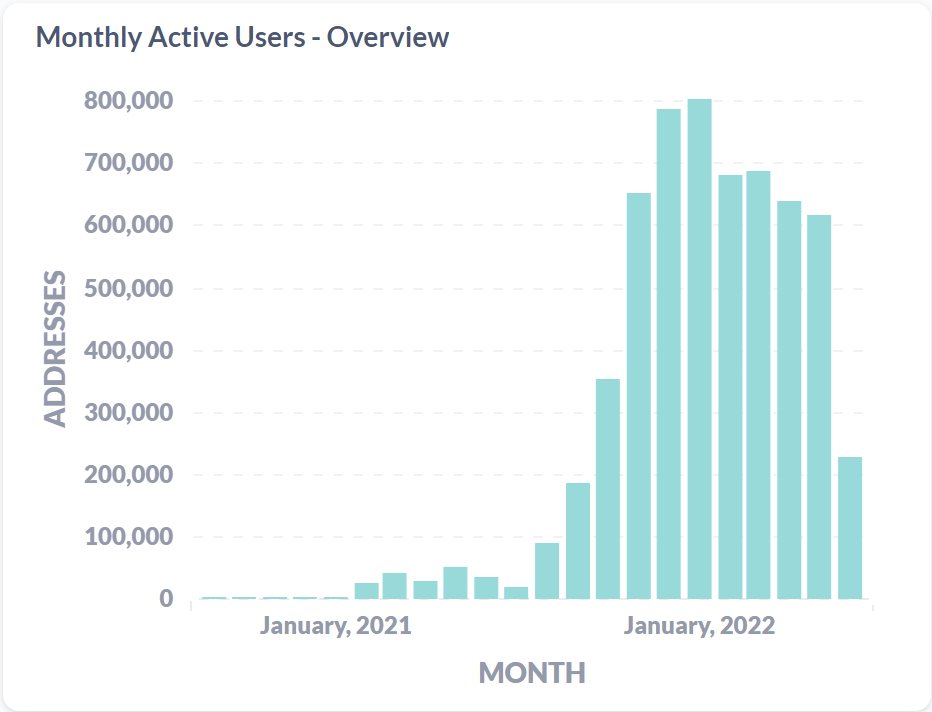

But monthly active users on the platform have slumped from 600k to only 200k in the project. TVL in the project has also dropped sharply with a move from $13bn in December to only $2,35bn.

CEL

Problems for Three Arrows Capital were exacerbated by troubles at the Celsius Network. The CEL token previously highs of $8.00 but has slumped to trade at only $0.65.

Alex Mashinsky’s Celsius project was the latest project to stumble after the crypto lender paused withdrawals due to “extreme market conditions.” During the freeze, the firm also un-staked around $247 million in wrapped Bitcoin (wBTC) from the Aave platform and sent it to the FTX derivatives platform with $74.5 million Ethereum (ETH). That led to fears of insolvency at Celsius and the company has reportedly hired lawyers for a restructuring plan. Digital lender Nexo has submitted a buy-out proposal and Celsius has until Monday to respond. The project also released a blog post on Monday saying:

We want our community to know that our objective continues to be stabilizing our liquidity and operations. This process will take time.

CEL has seen its market capitalization drop from $.80 billion to only $150 million.

SOL

Another coin in the crosshairs of the Three Arrows fallout is Solana and that could be a risk to the coin. Solana took action against a whale investor at the weekend in order to reduce recent volatility.

Users of Solana-based borrowing and lending service Solend voted at the weekend to force the takeover of the protocol’s largest account: a “whale” whose “extremely large margin position” was getting dangerous, according to contributors.

The governance vote will grant Solend Labs “emergency powers” to liquidate the whale’s vulnerable assets (around $20 million in SOL) via over-the-counter (OTC) trades instead of decentralized exchanges if the price of SOL drops too low.

Solend Labs said the size of the whale’s position “could cause chaos” in Solana’s DeFi markets. Fulfilling the trades via OTC markets would likely avoid that outcome. The supporters of the intervention argued that the Solend whale was no typical user. The account had parked 5.7 million SOL onto Solend, or over 95% of the pool’s deposits. The account had also borrowed $108 million in stablecoins.

Meanwhile, the project has completed upgrades to put an end to last year’s performance problems. Solana had issues last September when the chain went down for nearly 17 hours after it was overwhelmed by traffic coming from a DeFi token launch. There was a repeat in April this year, with a 7-hour outage, and another for four hours in June.

The problem was blamed on performance bugs in the blockchain and its transaction processing unit (TPU). Solana has always been hailed for its processing capacity but during the outages, the chain saw TPS dropping from the thousands to only double figures.

The developers have made changes to the chain in order to stop bots from sending unlimited traffic and clogging up the system.

Solana has dropped to number 9 in the list of coins and last year’s $250 highs are a distant target from today’s $35 price.