Bitcoin Trading Confined to Narrow Range: Is This the New Normal?

Bitcoin, Ethereum, and other cryptocurrencies, in general, have the tendency to be volatile. It is one property that makes the asset a high-risk-high-reward utility.

There have been instances where traders have earned millions of dollars in profit with crypto in a single month. For instance, Bitcoin reached its peak in November 2021 at $65,000. However, the crypto was valued at only $28,500 a year later.

Such is the volatile nature of crypto, at least what the traders were used to. In recent times, established cryptocurrencies, such as Bitcoin and Ethereum, have showcased much more market stability. Despite the industry facing regulatory demands, unethical branches, and lawsuits, BTC has maintained its market status and value. This is especially true for an asset that tends to shift from 5% to 10% in one day.

So what’s happening with Bitcoin price? Let’s dig deeper.

The Changing Face of Bitcoin Volatility

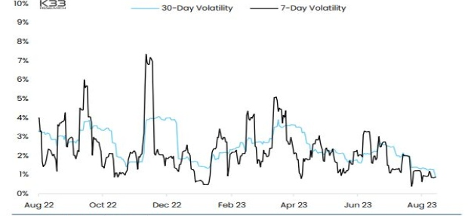

Bitcoin has maintained its low-volatile regime for several months now. Its current stretch has only been witnessed twice before in the decade-long market presence of crypto.

Although the crypto showcased some excitement back in June, it has been silent since then. In fact, crypto has managed to achieve the lowest 90-day volatility since 2016. Currently, Bitcoin stands at a 3-month implied volatility of 35. In comparison, the previous all-time volatility low of the crypto was 56, as per the K33 research report.

This was hit after Bitcoin spent 47 days without a 5% price shift. Thus, the ongoing stability shown by Bitcoin is much below its previous all-time lows.

Let’s put this tendency into a better perspective for clearer comprehension.

Bitcoin’s Historical Volatility

Bitcoin started its official market journey in 2011 when it hit a $1 market price. The crypto stayed under $5 throughout the year with a pattern of 80% to 90% price correction.

The king of cryptocurrencies, Bitcoin, took three years to reach the $1,000 mark before witnessing a whopping 85% market dip. However, things started picking pace in 2017 when the crypto ended the year at $20,089.

Bitcoin (BTC) changed the lives of thousands of traders in a year alone. The following couple of years were tough for Bitcoin as it kept declining gradually. However, it broke the pattern in 2020 by ending the year at $29,244. But all the previous wild volatility patterns pale in front of Bitcoin’s movement in 2021. The BTC price shook the crypto market by reaching a whopping $68,789 in market value. For an asset with such wild historical volatility to suddenly gain stability is unprecedented.

That is why several financial experts and institutions are trying to figure out what’s happening with Bitcoin.

Measures of Bitcoin’s Calmness

While writing this post, Bitcoin trading has been confined within the 24-hour range of $28,428 to $29,194, as per the data from CoinGecko.

However, even with this narrow fluctuation, the crypto has yielded a market cap of $555 billion. This pattern has surpassed even the stability of gold, tech stocks, and the S&P 500. As per Glassnode analysts, several Bitcoin metrics are hinting at extreme exhaustion and apathy toward the crypto. For better understanding, let’s see what upper and lower Bollinger Bands are.

Bollinger Bands uses three lines, upper, lower, and middle, to analyze an asset. The middle line is an SMA (simple moving average) of the asset’s price for a specific period. The lower and upper bands are placed a number of standard deviations away from it. The general setting for the band involves a 20-day SMA with 2 standard deviations.

For Bitcoin, the upper and lower Bollinger Bands are only separated by 2.9% currently. Such a spread has only been seen twice, in 2016 and 2021.

Bitcoin Price: What to Expect in the Upcoming Months?

With such market movement, it is natural for traders to look for a precise Bitcoin prediction. Traders have noted that Bitcoin’s most exciting movement came back in June. This happened primarily because of BlackRock’s involvement in a spot Bitcoin ETF. The crypto has calmed down since then, showcasing immense stability in August. Throughout the month, Bitcoin has been hovering around the 29k dollar mark in every trading session.

The CIO of Lestra Investment Management, Kara Murphy, stated that secular narratives surrounding Bitcoin could be its longer-term drivers. BTC disrupting traditional finance is one such example of a secular narrative.

As for its near-term, Bitcoin can be considered a high-risk call option for free money under some circumstances. What the market gas witnessed is that the Fed rate-tightening cycle has wrapped up. Thus, the long-term secular aspect is gaining prominence with BTC becoming stable.

Since such narratives do not change easily, Bitcoin is expected to be a bit more boring, added Murphy.

The Silence in the Crypto Market

The summer of 2023 is recorded as one of the calmest periods for Bitcoin. It is safe to state that traders had to constantly keep up with every crypto forecast to ensure the market wouldn’t suddenly unravel. Reports noted that the 90-day volatility of Bitcoin is at its lowest since 2016. And since its implied volatility is also at an all-time low, the silence is deafening to most traders acquainted with BTC’s standard movement.

Vetle Lunde and Bendik Schei, analysts at researcher K33, also cemented this statement. As per the analysts, the silence throughout this summer is why the volatilities are even below all-time lows. It has been an unusually calm stretch for BTC, an asset known for its wild price swings, added the analysts.

Conclusion

Bitcoin, a crypto renowned for its unmatched volatility, is currently trading at its all-time stable position. Its 90-day volatility is at the lowest ever since 2016, with August being the month when BTC only hovered around $29,000. In fact, Bitcoin has only maintained such market stability twice since its inception in 2011.

CoinGecko data shows that Bitcoin trading has been confined within the 24-hour range of $28,428 to $29,194. Such stability even overshadows that of gold, tech stocks, and the S&P 500. Since experts believe this stability is here to stay, traders are reevaluating their crypto trading strategies. If Bitcoin manages its market position and stability, it can redefine not only the crypto industry but the financial market as a whole.