Bitcoin Price Prediction: BTC/USD Briefly Falls Below $30,000; Are Bulls Fading Away?

Bitcoin (BTC) Price Prediction – January 4

Bitcoin price is now showing signs of market correction as its price moves below $30,000 to touch the low of $27,678.

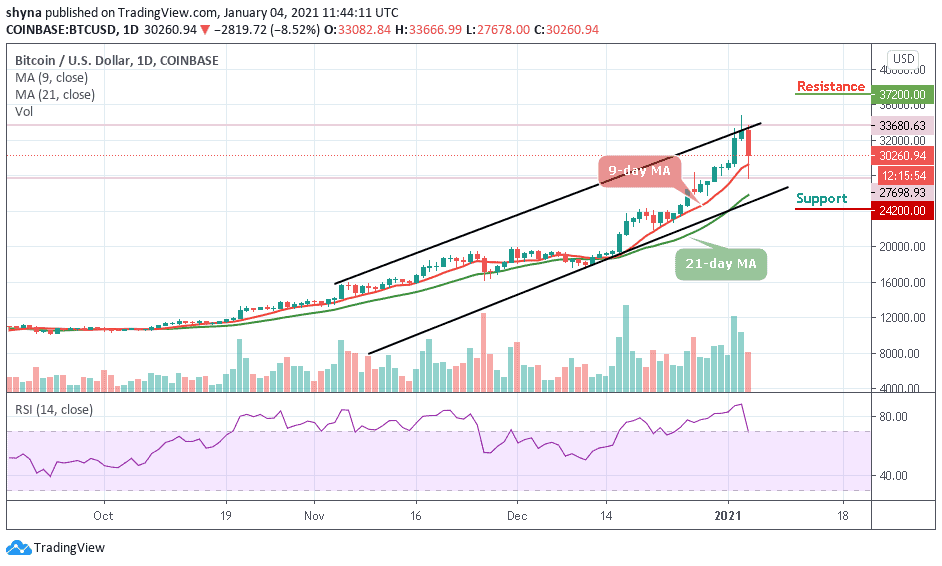

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $37,200, $37,400, $37,600

Support Levels: $24,200, $24,000, $23,800

After touching the daily low of $27,678, BTC/USD is now trading above the $30,000 level to recover the losses incurred in the early hours of today. The buying pressure in this zone proved to be surmountable in the last few days. However, this consolidation could be coming to an end according to derivatives data indicating that the king coin might soon drop more before climbing higher again.

Would Bitcoin (BTC) Go Up or Down?

At the time of writing, BTC is changing hands at $30,260, which marks a significant rally above a critical support level at $27,500. However, where BTC trends next may partly depend on whether or not buyers can close today’s candle above the $33,000 level. Should in case this comes to play, it may propel prices higher. And we expect BTC/USD to rise above $35,000 resistance which could later move towards the potential resistance levels at $37,200, $37,400, and $37,600.

In other words, if the Bitcoin price failed to close above $33,000 resistance level; the price could drop below the 9-day and 21-day moving averages. A further low drive could send the price to $24,200, $24,000, and $23,800 supports. The technical indicator RSI (14) has recently revealed a sign of trend reversal, which shows a possible bearish momentum, could play out.

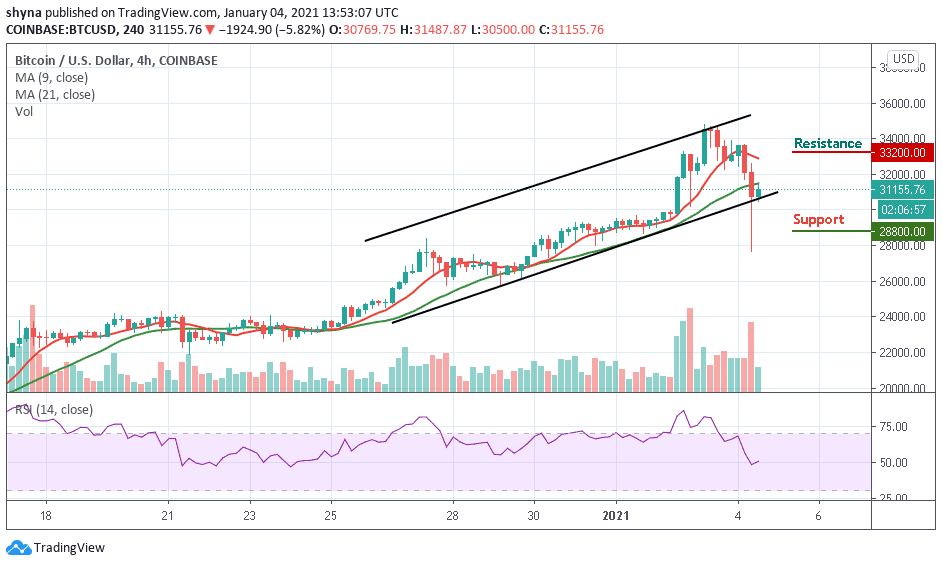

BTC/USD Medium – Term Trend: Bullish (4H Chart)

On the 4-hour chart, BTC/USD is currently trading around $31,155 under the 9-day and 21-day moving averages after a reversal from $33,636 where the market started trading today while the Bitcoin price is now moving towards the north.

However, if the buyers could strengthen and energize the market, they can further push the price above the moving averages and this could allow the market price to test the $33,200 and above. The RSI (14) is currently moving above 50-level, but any further movement to the south may drag the price to the support level of $28,800 and below.