Bitcoin Network’s Mining Difficulty Expected to See Largest Increase in Over 2 Months

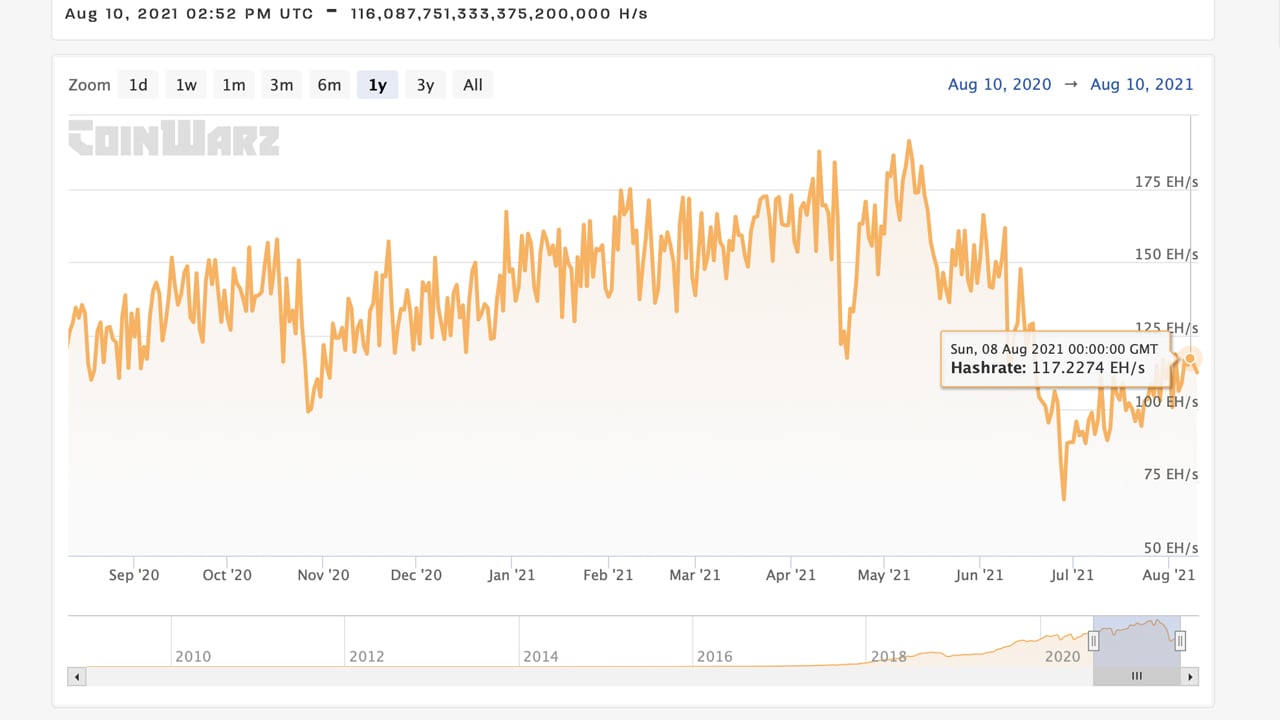

Bitcoin’s hashrate has been steadily climbing after dropping to 69 exahash per second (EH/s) on June 28, as it reached a high of 117 EH/s on Tuesday morning (EDT). The rise in hashpower will likely lead to the highest difficulty expansion in 89 days as estimates currently show a 7.39% increase is due in two days.

Bitcoin Block Rewards Expected to Be More Than 7% Harder to Find in 2 Days

In a touch more than two days’ time, Bitcoin’s mining difficulty is expected to jump over 7.3% as the crypto asset’s overall hashrate has improved a great deal. Since June 28, Bitcoin’s hashrate has jumped 69.56% and has been rising higher following the lift in market prices.

On July 15, Bitcoin’s hashrate hit a high of 130 EH/s holding just below that zone for the last 25 days, and once in a while, it has tried to surpass the metric. Bitcoin’s mining difficulty makes it more difficult for miners to find blocks and during the last epoch, it increased more than 6%. However, the largest increase since then was on May 13, 2021, when the difficulty increased by 21.53% that day.

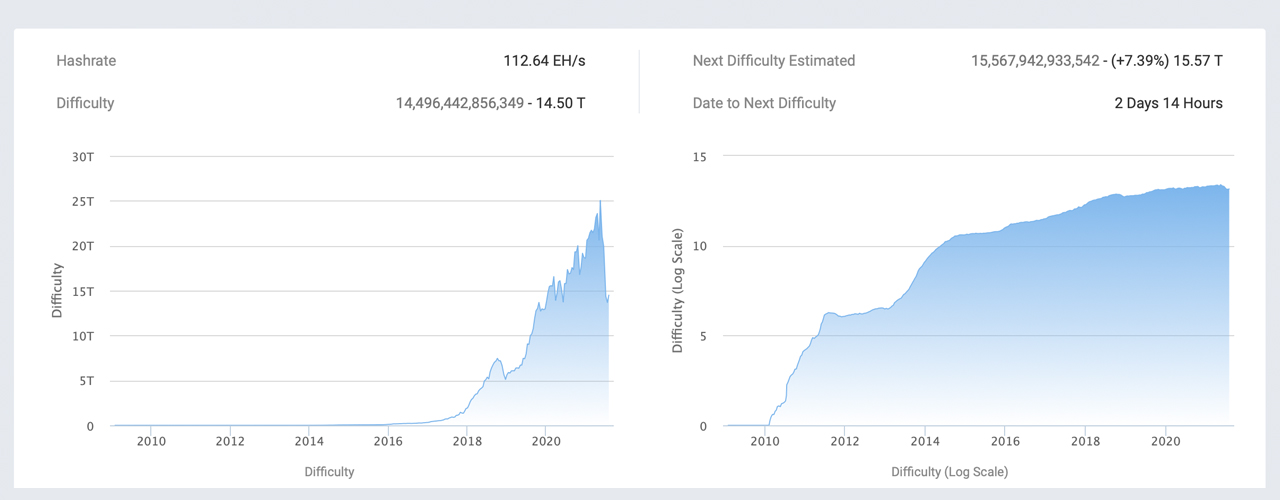

The next difficulty change shows an estimate of around 7.39% and could increase higher if the hashrate continues to climb. This means that over the last month, the difficulty will be close to 13.39% higher in two days. At the time of writing, BTC’s mining difficulty is around 14.50 trillion, and it is expected to be around 15.57 trillion after the next difficulty change.

Besides the May 13 change, the difficulty adjustment will be the highest change since January 9, 2021. While the difficulty makes it harder to find BTC blocks, it can increase and decrease depending on how much hashrate is dedicated to the blockchain.

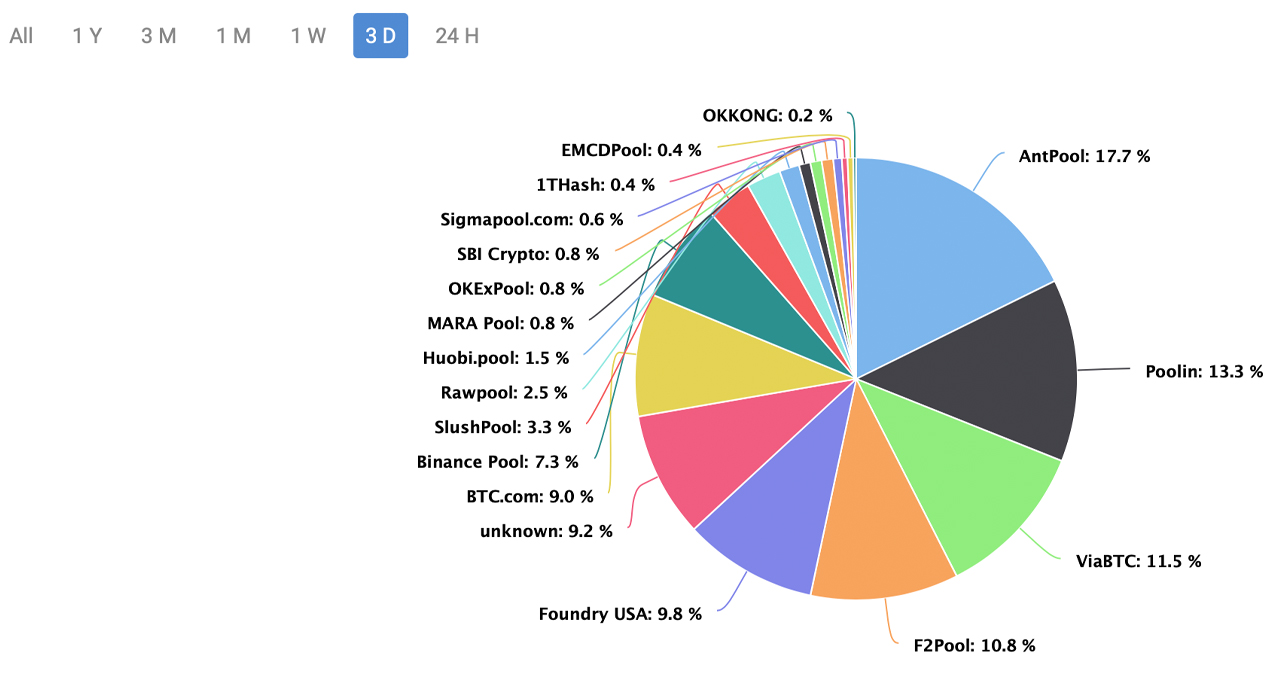

Antpool Still Commands the Top Spot, Bitcoin’s Inflation Rate Per Annum Is 1.76%, Bitcoin Halving Is 1,006 Days Away

On Monday, Antpool is the largest BTC miner, capturing 17.71% of the overall hashrate. Antpool has over 20 EH/s dedicated to the Bitcoin (BTC) blockchain and is followed by Poolin’s 15.12 EH/s of hashpower. With more than 15 exahash Poolin has over 13% of the network hashpower today while Viabtc commands the third position.

Viabtc’s 11.46% of the network hashrate derives from the 12.9 EH/s of hashpower it is applying to the chain. The fourth position is held by F2pool (10.83%), and the fifth-largest miner is Foundry USA (9.79%). Unknown hash or stealth miners still have a large quantity of global hashpower with 9.17% of the hashpower today or 10.9 EH/s.

As of August 10, 2021, there are approximately 1,006 days until the next block reward halving and it’s likely miners will try to mine with as much hashpower as they can until then. When that happens, the 6.25 BTC block reward will shrink to 3.125 coins per block post halving.

Give or take hashrate speed, there are roughly 144 blocks found every day and the BTC inflation rate per annum is only 1.76%. At the time of writing, the next difficulty retarget will be 386 BTC blocks away and at the current velocity of the network and market prices, it seems miners are in for a run of consecutive difficulty increases.

What do you think about the upcoming difficulty increase and the fact that Bitcoin’s hashrate has been recouping from the losses at the end of June? Let us know what you think about this subject in the comments section below.