Bitcoin Hits $52,000 with Stocks Above 5k, SOL, IMX, VET, Feb. 16

BTC

Bitcoin climbed to its highest price since December 2021, due to a surge in adoption for exchange-traded funds for the token.

The world’s largest cryptocurrency rose this week by 9% over the last week, trading at new highs above $52,000 for the year. Bitcoin is also about to post a seventh straight daily gain that would mark the longest streak since January 2023, according to data from Bloomberg show.

Nine new spot Bitcoin funds have started trading in the U.S. from January 22 and have since attracted more than $9 billion of investor inflows. Two of those offerings, from investment management heavyweights, BlackRock and Fidelity, are leading the pack as the most popular funds for retail investors. Crypto investment is also being boosted by positive market sentiment with the S&P 500 stock index above 5,000.

There are indications of an “increasing movement of institutional money into the asset class,” said Caroline Bowler, CEO at BTC Markets.

Grayscale Bitcoin Trust had more than $6 billion outflow initially, but that has slowed. The new collection of ETFs has attracted a net of over $2.8 billion overall. Some analysts also believe that gold ETF investors are moving into BTC with the funds seeing outflows of $2.4 billion this year.

However, Bloomberg’s Eric Balchunas also noted that “US equity FOMO” has also played a part, with the AI buzz propelling stocks higher.

There is also continued optimism about the Bitcoin halving due in April, which will see the quantity of Bitcoin that miners receive cut in half again. The halving plays on supply and demand, where decreasing gains mean that some miners might walk away from their operations.

The surge in BTC got the market above $52,000 and this can continue while stocks move higher.

SOL

Solana kept up its strong run of form and has tracked Bitcoin’s rise over the week, but there is a sign of exhaustion in the price.

Crypto analytics firm Santiment said that it was still bullish on the Ethereum competitor, despite a recent outage over the last week.

Crypto exchange Binance said that an outage at crypto exchange UpBit had forced it to suspend deposits and withdrawals of SOL and SOL-based altcoins, such as GMT (GMT), Raydium (RAY), and Access Protocol (ACS).

Data provider Santiment said that Solana’s development activity, which can be a bullish indicator for the price, will grow as the project rolls out new features.

“The outage that concerned traders Monday ended up being a local bottom, with the FUD fueling this price rebound,” Santiment said.

Bitcoin’s rise with ETF adoption has many coins following on speculative flows and ideas. SOL has support below at $92 and $80.

IMX

Immutable was one of the big performers this week with a gain of over 30%.

The project spiked to a two-year high recently, above strong uptrend resistance, as gaming tokens see a resurgence. Immutable, the native token of the gaming-centric Ethereum networks Immutable X and Immutable zkEVM, has risen to $3.2 recently.

That’s the highest price for IMX since February 2022, according to data from CoinGecko. Immutable is also the only gaming token to sit in the 25 cryptocurrencies by market cap. In December, investment firm VanEck predicted that IMX would achieve that goal in 2024, while it was trading at 31. At current prices, IMX has a market cap of around $4 billion.

Immutable has set itself apart from the Layer 2 scaling competition with a fast and reliable network.

IMX now trades at $3.11 and the key support will be at $2.80 where that previous resistance sits.

VET

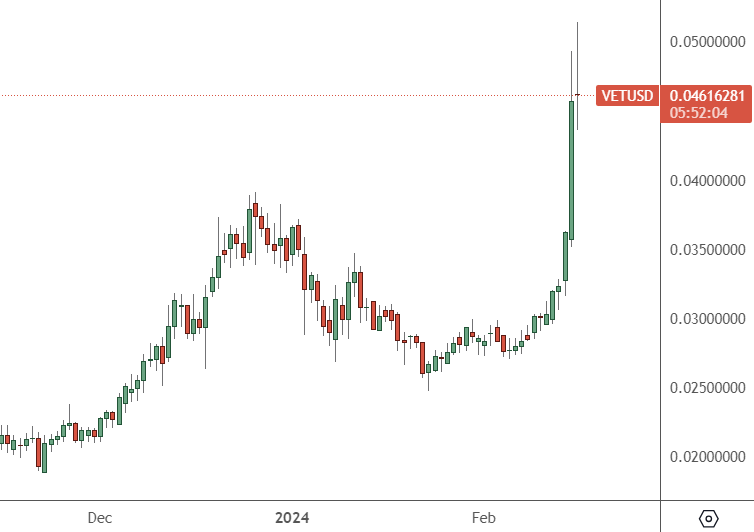

VeChain (VET) now trades in the top 30 after a 56% surge in price this week.

Investors are recognizing the project’s transformative potential of blockchain in supply chain management, and have jumped into Option2Trade’s (O2T) $888k giveaway. Option2Trade has an innovative platform, which has elements of AI involved.

With VeChain’s focus on supply chain innovation resonating with the new project, traders are seeing the opportunity for both projects to combine their business plans in the future. Anything related to artificial intelligence has soared in 2024, adding a speculative flow to crypto projects.

Speculation has also been building about a major announcement for VET on environmental sustainability.

Crypto analyst Ali Martinez on X, suggested that was nearing the end of its consolidation phase recently. Martinez said:

“It feels like it will be a big week for #VeChain! If history repeats itself, $VET could be looking at a move to $0.054 this week, a brief correction until June, and then a bull run to $0.70 by November”.

Martinez was right about the bull run move and with the momentum on its side, VET could be heading for those higher levels this year.

VET now trades at $0.046 after the recent price surge. The project has a market cap of $3.37 billion but that is down from around $15 billion in 2021.