Bitcoin Higher After BlackRock Files ETF Application, BNB, TWT, SUI, Jun 19

BTC

The price of Bitcoin was 2.5% higher after asset management giant BlackRock filed an application for a Bitcoin ETF.

BlackRock’s iShares unit filed paperwork with the SEC on Thursday seeking the creation of an exchange-traded fund that would use spot market pricing and custody from Coinbase.

There was some hesitation from traders as the SEC has rejected spot ETFs before and is currently in a court battle with Grayscale over its attempt to create its own spot ETF.

In early court hearings over the matter, the SEC had said that the futures market is a better option due to its regulated nature and ability to stop market manipulation.

If the BalckRock ETF did get approved it could open the door to new trading volumes and adoption for BTC. The company is the world’s largest asset manager and the prospectus states that the ETF would be fully backed by BTC.

The price of Bitcoin found support at the $25,200 level recently and is moving within a channel. A breakout above the $27,000 level could see further gains ahead.

BNB

The price of Binance Coin (BNB) should be a focus for crypto investors with a key support level in play.

A recent slump on the back of legal problems has seen the coin drop to $243.60 but the key support is $210. If the price of BNB went below that level, which marked the lows of June 2022, it could affect the profitability of the exchange. The spark for the demise of the FTX exchange was weakness in its FTT token, which had been used excessively as leverage in the platform.

The problems have been piling up for Binance in recent weeks, with the lawsuit against the company from U.S. regulators. Last week saw France starting a money laundering investigation against the firm, while the company withdrew from business operations in the Netherlands. Binance also withdrew an application for registration in the United Kingdom.

The company’s U.S. business, Binance.US saw a court order to allow users to withdraw funds but managed to avoid a full asset freeze in exchange for restrictions.

“The SEC’s request would have effectively shuttered our business, which is consistent with the agency’s continued attempts to kill the crypto industry by any means, even by making allegations that are not supported by the facts,” Binance.US said in a tweet.

The SEC requested funds be repatriated and segregated from business operations to ensure U.S. investors could withdraw their funds from the exchange. The SEC filed a total of 13 charges against Binance.US, Binance, and its CEO Changpeng Zhao on June 5.

Traders should keep an eye on the price of BNB over the coming weeks as it could drag the sector lower.

TWT

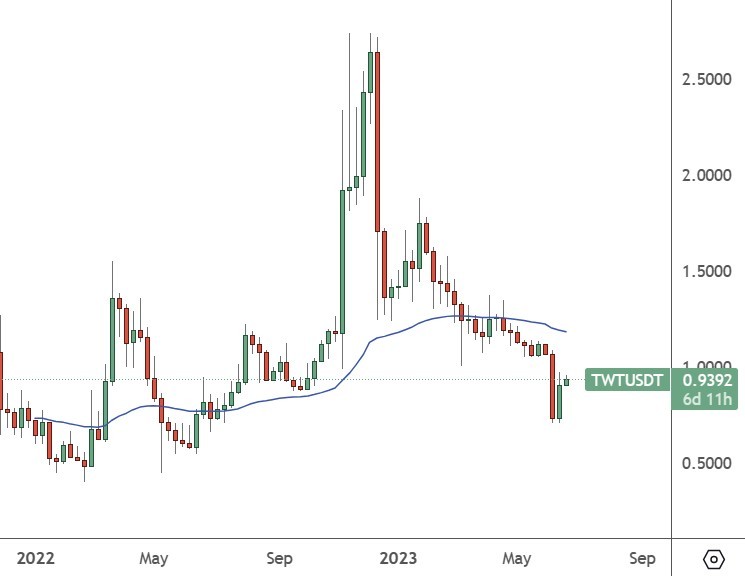

The price of Trust Wallet (TWT) was 28% higher this week as recent exchange issues have seen users move assets to cold wallets.

The same dynamic boosted the price of TWT in early-2023 after the collapse of the FTX exchange in November. The recent lawsuits from the Securities and Exchange Commission (SEC) have rattled investors with some moving assets from hot wallets to offline storage. The Trust Wallet platform boasts over 60 million users. Traders can buy and sell crypto in the wallet and also see their NFTs in one place. There is also an Earn function, where users can stake coins for up to 11% APY.

Bitcoin’s recent negative price action added to selling pressure on 97% of altcoins in the top 100. Data from CoinGlass showed market liquidations of $162.7 million in total liquidations for a 24-hour period before BTC mustered support at $25k. The price of Trust Wallet token will come into focus again if the problems get worse for Binance.

The price of TWT has risen on the week to $0.9380 and investors could see a move above $1.00 this week with the potential for larger gains as the regulatory picture develops.

SUI

The price of SUI was higher by 16% with the project moving to number 76 in the list of coins.

SUI is a Layer 1 blockchain that was launched in May 2023 and offers scalability and low latency. The network is designed to be user-friendly for developers and provide a low-cost blockchain for decentralized applications.

The platform is written in Rust and supports smart contracts through its Sui Move, however, it is slower than many competitor blockchains with 137 transactions per second.

The SUI platform also includes the MIST native token which can be used to pay gas fees, and network transactions, such as minting NFTs or buying and selling tokens. The SUI token is already listed on major exchanges such as Coinbase, Binance, and Gemini.

SUI currently trades at $0.76 with a market capitalization of $462 million.