Bitcoin (BTC) Price Prediction: BTC/USD in a Range as Bitcoin Trades Marginally

Bitcoin (BTC) Price Prediction – June 7, 2021

For the past 48 hours, BTC/USD has been fluctuating above $35,000 support as Bitcoin trades marginally. The recent bearish momentum from the $39,000 high extended to the low above $34,900. Bitcoin price found support as buyers continue to defend the critical support at $34,000.

Resistance Levels: $45,000, $46,000, $47,000

Support Levels: $35,000, $34,000, $33,000

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider

Following the last breakdown on June 5, BTC’s price fell to $34,822 low as bulls bought the dips. The bulls buying the dips push BTC’s price to remain above the critical support at $34,000. Also, the market rises to $36,700 high. The bullish momentum was restricted below the recent high. For the past three days, Bitcoin price has been fluctuating in a narrow range between $35,000 and $37,000 price levels. Buyers have the advantage to propel and sustain the BTC price above $36,700 resistance. If successful, a break above $38,000 high will catapult Bitcoin above $40,000 high. Conversely, if the bears take the initiative and break below the $34,000 support, Bitcoin will further decline to the $30,000 or $28,000 support zone.

In 2021, Discounted Bitcoin Is Likely to Hit $100k than $20k, Says Bloomberg Analyst – Bitcoin Trades Marginally

Mike McGlone is the senior Bloomberg commodity strategist who said the bull market appears to be intact to achieve a $100,000 target price than retracing to $20,000 low. The analyst indicated this notwithstanding the massive drawdown in May. McGlone gave an example of an overextended rally, Chinese restrictions, and unwarranted focus on Bitcoin’s energy use as causes for the May drawdown. McGlone noted that: “Toward the end of 2020, Bitcoin’s history suggested the crypto would move sharply higher in 2021, and we see improving supports for this.” He continued: “In 2020, 260-day volatility dropped to its lowest ever vs. most major asset classes, notably the S&P 500. Add last year’s supply cut, the migration to institutional portfolios, Ethereum futures, and the launch of ETFs in Canada and Europe, and we see greater potential for Bitcoin to head toward $100,000 than sustain below $20,000.”

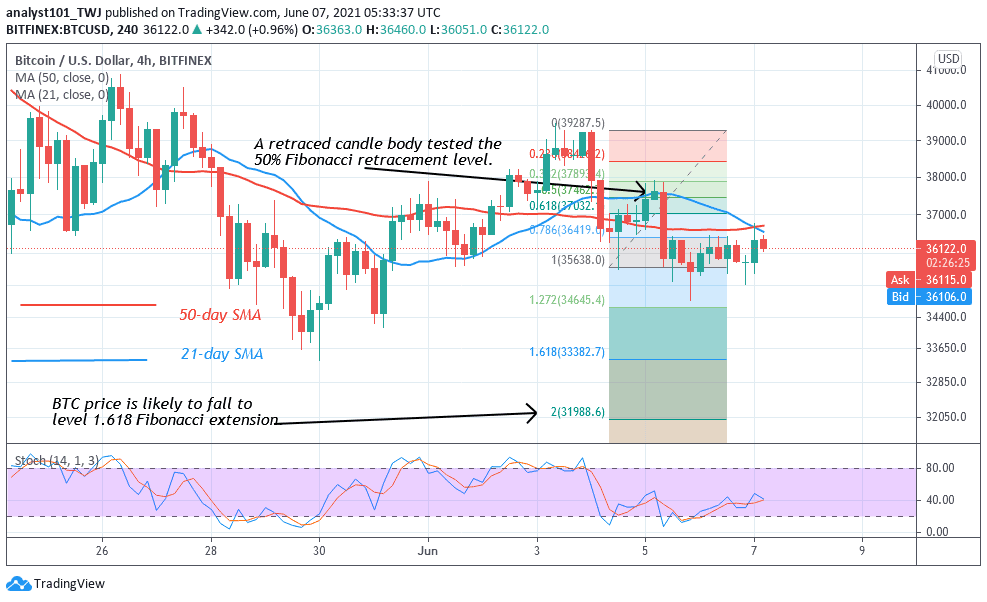

Meanwhile, Bitcoin’s price is consolidating above $35,000 after the recent breakdown on June 3. On June 4 downtrend; a retraced candle body tested the 50% Fibonacci retracement level. The retracement indicates that the BTC price is likely to fall to level 1.618 Fibonacci extension or level $31,802.30. From the price action, the selling pressure has subsided as price resume consolidation above $35,000.