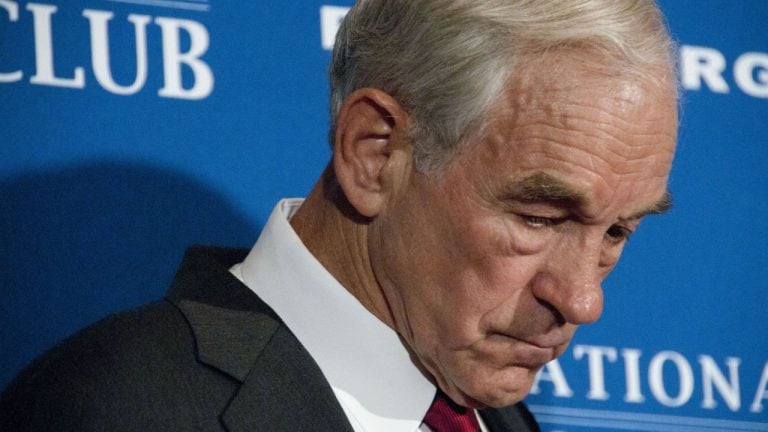

Ron Paul States Federal Reserve’s ‘Decade of Near 0% Rates’ Caused Today’s Financial Crisis

Former House Representative Ron Paul has presented his stance when it comes to the financial crisis that the U.S. is currently facing. Paul stated that the continued application of quantitative easing (QE), a policy used to increase the money supply, and the decades of almost null interest rates, are what nurtured the current financial crisis the U.S. is facing.

Ron Paul Believes Federal Reserve’s Policies Created Today’s US Financial Crisis

Ron Paul, former representative and presidential candidate, has recently talked about the financial crisis the U.S. is facing. According to him, the policies that the Federal Reserve applied to maintain a welfare state at the cost of creating deficits have created today’s financial hardships for the country.

Paul stated:

Today’s financial hardships stem from the Fed’s decade of near 0% rates and quantitative easing (QE). These created a decade’s worth of uneconomic investments. Every bad idea imaginable received funding.

Paul criticized loose monetary policies he says allowed bad debt to be created with credit going to non-profitable investments, and this situation is now becoming unsustainable to the tightening of economic conditions. Paul explained that “as much as a ‘hangover’ after the consumption of too much alcohol is painful, so is it painful when a fake prosperity crashes with economic reality.”

‘The Fed Is Unconstitutional’ but Part of the Solution

Paul, a longtime critic of the validity of the existence of the U.S. Federal Reserve and its faculties, praised the action of the institution that is currently trying to rein in inflation by raising interest rates, even if this has affected the banking system according to government spokespersons.

On this, Paul remarked:

Rising interest rates under Powell are the cure and road back to some form of economic sanity. The Fed shouldn’t exist. It’s unconstitutional and immoral. But rising rates are not the source of our problems. The big blunder was 0% rates and QE.

Paul has been alerting the public about the progression of the de-dollarization process and the effects that losing reserve currency status might have on the U.S. While he believes that the de-dollarization process has recently accelerated, with the recent activities of the BRICS bloc, he stated this will likely take longer than some predictions indicate and that there is no established timeline for this to happen.

What do you think about Ron Paul and his opinion about the role of the Federal Reserve in the U.S. financial crisis? Tell us in the comments section below.