Ethereum Rallies as Spooked Investors Turn to Crypto, CFX, AGIX, USDC Mar. 21

ETH

Ethereum rallied over 20% and Bitcoin was over 30% higher investors turned to crypto after the fallout from the Silicon Valley Bank collapse.

Nexo’s Co-Founder Antoni Trenchev told Yahoo Finance:

We are seeing a flight into Bitcoin and Ethereum because people want to escape some of the smaller caps and some of the stablecoins that are out there.

However, he also worried that the shutdown of Signature Bank could have an adverse effect on the industry.

“I do not know what exactly was wrong at Signature Bank. And I’m no fan of conspiracy theories, but it’s obvious right now that the blockchain space has very limited access to fiat and that the banks that were servicing the space are all but gone,” he added.

“… new money, if it wants to come into the space from US dollars to crypto-native assets, will have a really hard time. So the second-order effects of the shutoffs of the fiat ramps will be felt in the months to come”.

However, the two largest cryptocurrencies surrendered some of their gains on Monday and one ETH whale had moved over $33 million worth of ether to Binance.

The price of ETH has hit resistance at $1,800 and may pull back to test the recent breakout level around $1,660.

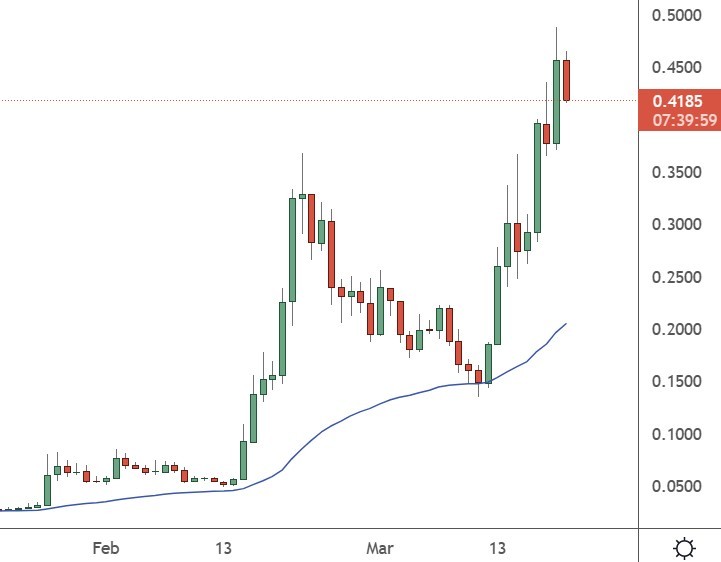

CFX

Conflux Network led the market for the largest altcoins with a 74% rally for the week. The move has brought CFX to a $1 billion market cap and into the top 50 coins.

Conflux has been receiving a lot of investor attention in 2023 as it is a Chinese crypto project. Although the country’s government took a hard-line approach to crypto in the past, there is hope that they have cooled their regulatory efforts, which was evident in the technology space.

The government is now said to be taking an interest in Hong Kong’s approach to digital assets, while Chinese corporations, such as China Telecom are also moving forward. The company is said to be collaborating on sim cards that are based on blockchain technology.

Conflux is a layer 1 blockchain in the style of Ethereum that utilizes a unique Tree-Graph consensus algorithm. This allows for the parallel processing of blocks for increased speed and scalability.

At present, Ethereum relies on third-party scalers to achieve this goal, with gas fees still expensive on the ETH network.

The price of CFX now trades at $0.41 after a surge from $0.05 in February.

AGIX

SingularityNet (AGIX) was up over 20% this week and this is another project to see strong gains this year.

The project rose along with other artificial intelligence (AI) cryptos and hit resistance around the $0.580 price level.

AGIX is now the second-largest token by market value in the AI space, behind The Graph. The latter has $1 billion in market cap versus the $580 million.

The latest gains for SingularityNet (AGIX) have come from the launch of a utility token by the project. Rejuve (RJV) was launched with the goal to speed developments in human health and lifespans. SingularityNET’s thrust, in terms of the social impact it aims to achieve, is quite The new coin can add value to SingularityNet and its goal to “create, share, and monetize” AI services through its global AI marketplace. Users of the marketplace can purchase developer services or offer them and the project will also benefit from the knowledge database that those offerings provide.

The price of AGIX may have topped for now, with a potential pullback to $0.400 in the works. The potential to grow further with AI advancements will continue to support the coin.

USDC

The price of the USDC stablecoin was able to regain its peg to the U.S. dollar after a rocky period brought on by the collapse of Silicon Valley Bank.

Circle, the founder of the second-largest crypto stablecoin had said that $3.3bn of its deposits were held in the failed lender. That led to traders selling the coin for fear of it losing its secure status. Once the Federal Reserve and other regulators announced that all depositors would see the return of their funds, the USDC coin rallied back to its $1.00 peg.

Problems at Circle could’ve been bad for the overall market with Coinbase and Binance among the exchanges suspending trading in the coin until the issues were resolved. USDC has returned to its $1.00 peg but has been unable to see deposits return. The project has $36 billion in deposits after dropping from $43 billion. The project currently has around half the market value of the tether stablecoin.

On March 13, Circle announced that Cross River Bank would be the company’s new commercial banking partner assigned to creating and redeeming USDC. Cross River Bank also provides services to Coinbase, while Circle will further its ties to Bank of New York Mellon. The firm’s remaining SVB funds will be transferred to BNY, which already provides custody for Circle reserves.