Bitcoin Drops with Inflation and Regulatory Fears, EOS, SNX, IMX, Mar. 6

BTC

Bitcoin’s rally ran into resistance with a 4.7% drop on the week as traders fear higher inflation and regulation.

Securities and Exchange Commission (SEC) Chair, Gary Gensler, rattled crypto markets again with his comments on crypto exchanges. Gensler’s statement—part of prepared remarks before a virtual public meeting last week—following a February 15 vote by SEC commissioners to expand the asset custody rules to include cryptocurrencies.

Based upon how crypto trading and lending platforms generally operate, investment advisers cannot rely on them today as qualified custodians. To be clear: Just because a crypto trading platform claims to be a qualified custodian doesn’t mean that it is.

His comments mean that institutions and professional investment advisors may find it hard to deal with certain exchanges.

An announcement the following day by Coinbase said that the U.S.-listed exchange had acquired One River Digital Asset Management. ORDAM is an SEC-registered investment advisor and Coinbase will have SEC favor for a qualified custodian, so the company was obviously anticipating the SEC vote.

European inflation came in higher last week and the continued expectation for elevated interest rates is hurting Bitcoin. BTC was trading at $22,455 on Monday with support at the $21,500 level. A break lower would target $20,000 once again.

EOS

EOS was once a regular player in the top ten crypto coins by market cap. The rise of decentralized finance and other crypto technologies saw the coin drop out of contention and it is now at number 40.

However, the project is looking to mount a revival with a coming upgrade in April. EOS has a new development team and is aiming at other sectors, such as gaming and the metaverse. EOS was a big name in the early days of crypto with the project raising $4bn in its initial coin offering (ICO) and the token reached a market cap high of $14 billion.

EOS Network Foundation’s new CEO, Yves La Rose, is leading plans for a consensus mechanism upgrade, an Ethereum Virtual Machine (EVM) solution, and a new growth strategy. The EVM mainnet is slated for an April 14 release, with updates and improvements planned in the weeks and months to follow.

“Combining the performance of EOS with the familiarity of Ethereum, Solidity developers are in for a treat,” Rose tweeted.

At 800+ swaps per second, $EOS EVM will be BY FAR the fastest EVM, benchmarked 3x faster than Solana + BNB and 25x faster than Avax.

With these developments, total value locked (TVL) has already increased $50 million since the start of this year in the lead-up to April’s EVM launch.

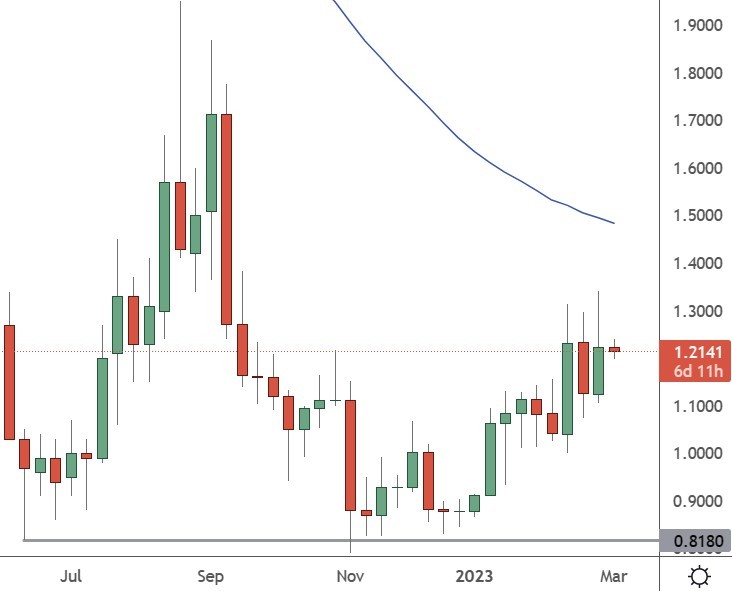

The price of EOS now trades at $1.214 and is looking to push higher with resistance at the $1.500 level.

SNX

Synthetix’s native token SNX has been one of the few cryptocurrencies to find a bullish bias in the last two weeks.

Synthetix has recently announced a new milestone that has the potential to boost its liquidity operation, with its Synthetix V3 now live on the mainnet. This is an important milestone for the network because it will facilitate a transition to a distributed pool model, compared to the previous debt pool of liquidity approach.

The main advantage of the transition is that liquidity providers can now contribute to liquidity in different pools across multiple markets. Synthetix plans to make the pools permissionless and hopes to entice liquidity providers to the chain, boosting its TVL. There was some excitement on the initial announcement with Synthetix joining the list of the most used smart contracts among the top 100 ETH whales.

Finally, SNX’s on-chain volume indicator reached its highest 4-week levels at the end of August, which shows that there is robust demand for the project.

The price of SNX has now moved to $3.21 and is testing the 50 moving average. A move above can target the $4.00 level.

IMX

Immutable X has continued to gain from its partnership with Warner Bros with the launch of the web3 mobile game Blocklete Golf from Discovery Sports on Immutable X.

Last month, Warner Bros added a web3 quiz game to create the Bleacher Report Watch-to-Earn (B/R W2E game.) In addition, Warner is building on its partnership with Immutable by migrating Blocklete Golf from Flow to Immutable X. The migration is reportedly due to the “fast transactions and gas-free NFTs minting backed by Ethereum’s robust security and decentralization.”

Andrew Sorokovsky, VP of Global Business Development at Immutable, said”

Last month, Warner Bros added a web3 quiz game to create the Bleacher Report Watch-to-Earn (B/R W2E game.) In addition, Warner is furthering its partnership with Immutable by migrating Blocklete Golf from the Flow blockchain to Immutable X. The migration is reportedly due to the “fast transactions and gas-free NFTs minting backed by Ethereum’s robust security and decentralization.”

Blocklete Golf is an interactive traditional mobile golf management game that allows players to guide golfing characters across virtual links in PvP matchups and tournaments. The game features the evolved Play-and-Earn model, which has become the default for many games looking to move away from the Play-to-Earn model, which saw Axie Infinity rise to stardom during the last bull run.

Blocklete Golf looks to set the game apart from other web2 mobile games by allowing gamers to collect, train, and trade unique NFT-based avatars or use them to compete with others.

The price of IMX trades at the $1.03 level and has the potential to test the $1.30 resistance level again.