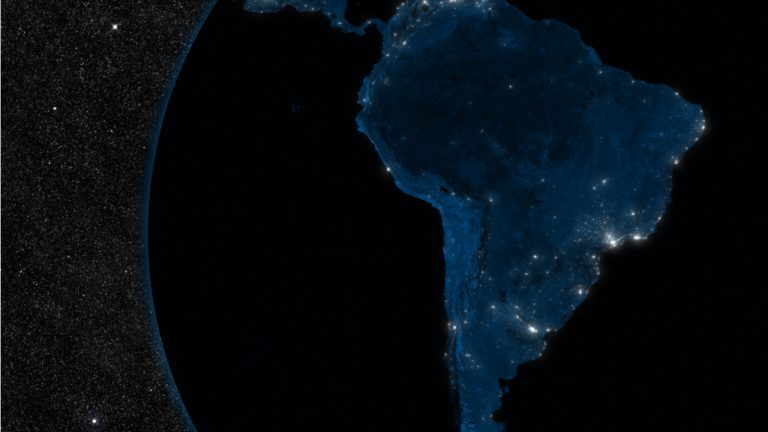

Latam Still Unprepared to Deal With Crypto Crime and Scams, According to GFI Report

Latam is still unprepared to deal with cryptocurrency-related crimes and scam situations, according to a recent report issued by Global Financial Integrity (GFI), a Washington DC-based think tank. The document states that crypto regulation has failed to grow with the adoption of these new technologies and that governments have often failed to detect and punish crypto-related crimes.

GFI: Latam Still Vulnerable to Crypto-Related Crime

While the adoption of cryptocurrency has grown immensely in Latam due to the unique economic situations and difficulties of the countries in the area, cryptocurrency regulation has failed to develop on par. This is one of the conclusions that a report titled “Cryptocurrencies: A Financial Crime Risk within Latin America and the Caribbean,” issued on Nov. 14, found.

Produced by Global Financial Integrity, a Washington DC-based financial think tank, the report examined the legal cryptocurrency developments in Latam and the Caribbean, focusing on countries with high crypto adoption like Argentina, Brazil, Colombia, El Salvador, and Mexico.

The report found several holes in the regulations of some of these countries that could allow criminals to use crypto to commit money laundering crimes which could go undetected by the authorities. Also, the study remarks that some of these countries still lack crypto-specific regulations to tackle more than just crypto taxation, given that Latam’s cryptocurrency usage follows different trends compared to other regions.

Policy Recommendations

As per the study, it is fundamental for these countries to understand that cryptocurrencies are a new asset class that calls to be studied in order to establish effective regulations, taking the needs of each one of the countries in Latam into account. The promotion of campaigns that educate about crypto and the possible risks that users and investors can face while using these new currencies is another tool that governments can utilize.

However, according to the report, one of the most important measures that these governments must apply has to do with the implementation of KYC/AML (Know Your Customer/Anti-Money Laundering) protocols amongst service providers, which can serve to identify possible threats.

In the same way, the adoption of the recommendations of international organizations like the Financial Action Task Force (FATF) is advised, in conjunction with the interconnection of these agencies to collaborate and exchange data that could lead to prosecuting suspected criminal cases.

What do you think about GFI’s latest report on the vulnerabilities that Latam countries face regarding cryptocurrency-connected crimes? Tell us in the comments section below.