Bitcoin Price Prediction: BTC/USD Pushes Towards $40,000 as Uptrend Kicks Off

Bitcoin (BTC) Price Prediction – February 3

The Bitcoin price has been facing some mixed price action in recent days, with the crypto seeing multiple strong uptrends and selloffs.

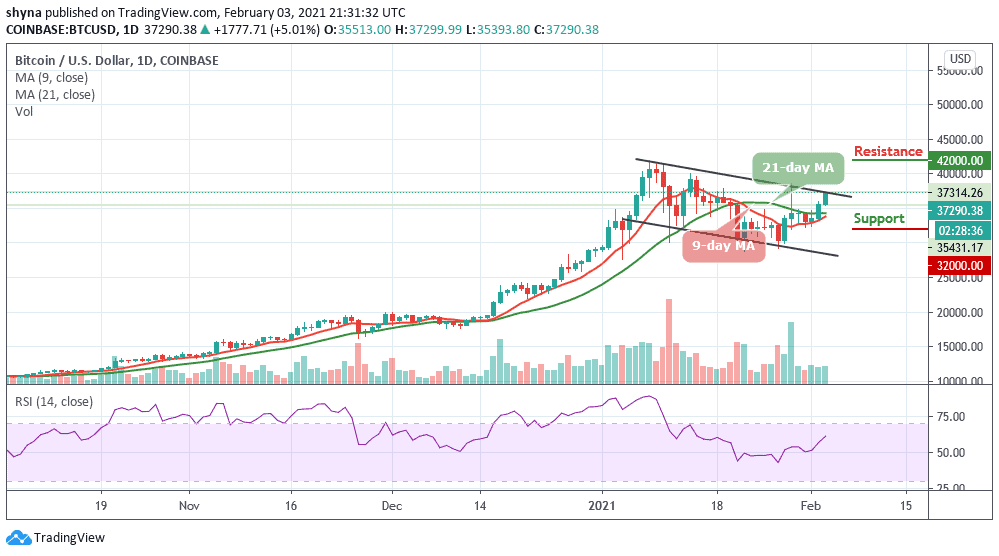

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $42,000, $44,000, $46,000

Support Levels: $32,000, $30,000, $28,000

At the time of writing, BTC/USD is trading up just above 5% at its current price of $37,290, which marks a notable surge from recent lows of $35,393 that were set in the early hours of today. However, the king coin’s strength is showing few signs of degrading, with bulls aggressively buying each dip as bears struggle to gain any momentum. Meanwhile, where the crypto trends in the mid-term will undoubtedly depend largely on whether or not it can break above $40,000.

What to Expect from Bitcoin (BTC)

At the time of writing, BTC/USD is trading up marginally at its current price of $37,290. Although this marks a meaningful climb from the opening price of $35,513, it is important to note that this seems to mark a bull-favoring break above the 9-day and 21-day moving averages.

Meanwhile, as the technical indicator RSI (14) faces the north, a sustainable move above the upper boundary of the channel could locate the potential resistance of $38,500, reaching this may allow for an extended recovery towards $42,000, $44,000, and $46,000 respectively. On the contrary, any bearish movement below the moving averages may force the Bitcoin price to hit the supports at $32,000, $30,000, and $28,000.

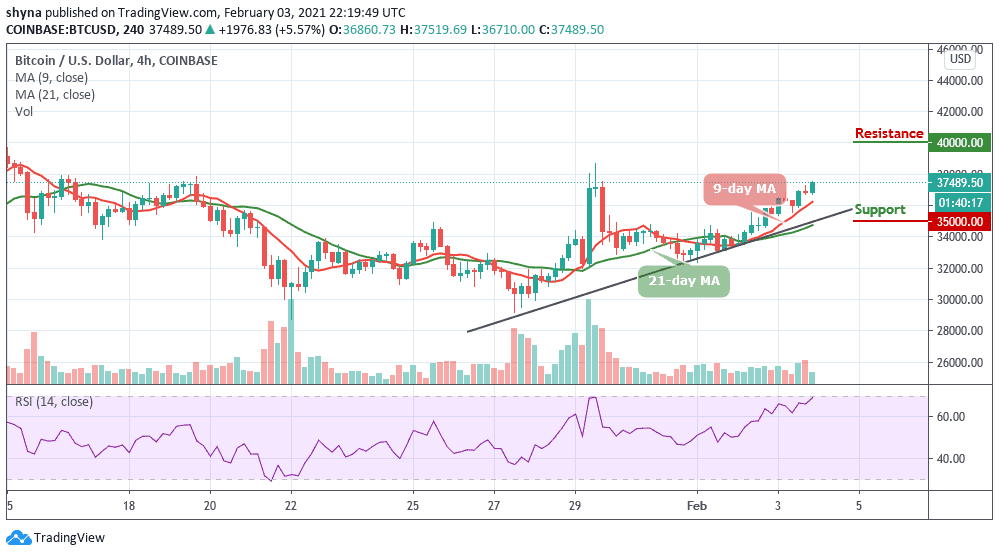

BTC/USD Medium-Term Trend: Bullish (4H Chart)

According to the 4-hour chart, BTC/USD should recover above the $38,000 resistance level to mitigate any short-term bearish pressure and allow for an extended recovery towards $39,000. A higher resistance may be found at $40,000 and above.

In contrast, the nearest support is located at $36,000, and a sustainable move below this level may increase the downside pressure and push the price towards the support level of $35,000 and below. Considering that the technical indicator RSI (14) continues to revert to the upside, therefore, traders might expect that more bullish signals may play out.