Bitcoin Price Prediction: BTC/USD Pulls Back Below $31,000; Could it be Under Threat?

Bitcoin (BTC) Price Prediction – January 27

BTC/USD continues to consolidate underneath a $30,000 barrier and on top of critical support $30,500.

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $37,000, $39,000, $41,000

Support Levels: $27,000, $25,000, $23,000

BTC/USD price is now facing down with 3.11% in value. It is likely to retain this bearish vibe in the near-term as the technical indicator moves below the 50-level, shifting focus from the upside. At the time of writing, the Bitcoin price is hovering at $31,449 below the 9-day and 21-day moving averages.

Where is BTC Price Going Next?

The critical support at $31,000 may be tested to the downside as the price consolidates. Failure of the noted support would likely see the price crossing below the lower boundary of the channel. This area is likely to slow down the correction and serve as a jumping-off ground for another recovery attempt; however, if it is out of the way, the support level of $27,000, $25,000, and $23,000 may come into focus.

In the meantime, BTC/USD is trading at the negative side amid a building bullish momentum. More so, the Bitcoin (BTC) is still fighting to correct the subtle bearish movement, and the bullish trend coupled with the right volume and high volatility level is the right ingredient for the recovery to $35,000 in other to resume its upward movement towards $37,000, $39,000, and $41,000 resistance levels.

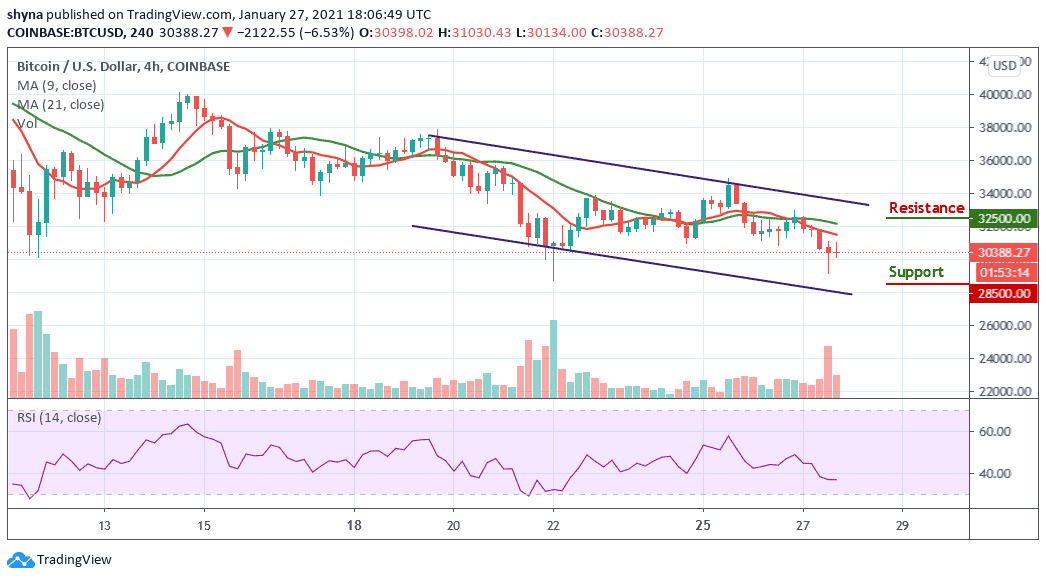

BTC/USD Medium-Term Trend: Bearish (4H Chart)

Checking the 4-Hour chart, BTC/USD is currently trading below the 9-day and 21-day moving averages. Nevertheless, Bitcoin has not yet slipped below $30,000 and still in the loop of breaking or making a bounce back. BTC price hovers around $30,388 and may take time to persistently trade above $31,000. The upward movement may likely retest the $32,500 and $33,000 resistance levels if the bulls regroup again.

On the downside, the price could fall below $30,000 if the bears put more pressure on the market, a further movement could test the critical support at the $28,500 level and below. The RSI (14) moves below the 40-level, indicating a bearish movement.