Bitcoin Price Prediction: BTC/USD Stagnant Under $32,000; Price Correction Still in Focus

Bitcoin (BTC) Price Prediction – January 23

The Bitcoin price is seen slowing down for another correction within the upward trend.

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $39,500, $41,500, $43,500

Support Levels: $25,500, $23,500, $21,500

BTC/USD may need to face a setback for now; this might not be a permanent one. The coin is likely to have a bullish run in the short-term but a price rally may help the coin to cross above the 9-day and 21-day moving averages. Currently, Bitcoin is trading around $31,857 level after a free fall from $35,498 a few days back. The coin has shown tremendous volatility over the past 14 days.

What to Expect from Bitcoin (BTC)

Looking at the daily chart, the 9-day moving average is crossing below the 21-day moving averages which may cause the market to focus on the downtrend while the $25,500, $23,500, and $21,500 may serve as the major support levels, making room for the king coin to fall even further. Meanwhile, the technical indicator for the coin is now preparing to visit the south once again as trading volume is fading out.

On the other hand, if the market were to rebound, traders could see the next buying pressure above the moving averages and this may push the market price towards the resistance levels of $39,500, $41,500, and $43,500. Meanwhile, BTC is now building a bearish trend on the daily chart, with the RSI (14) moving below 50-level.

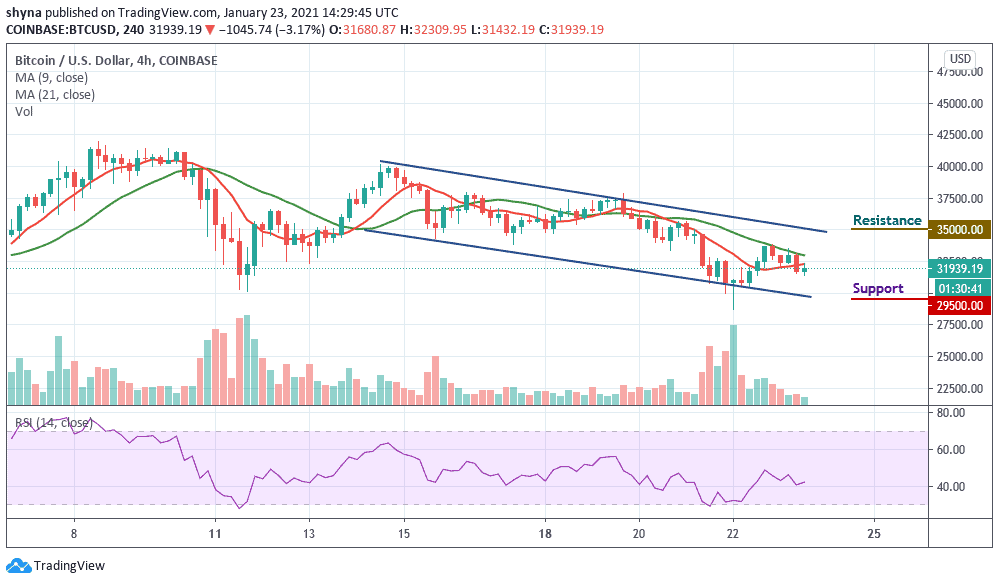

BTC/USD Medium – Term Trend: Bearish (4H Chart)

Looking at the 4-hour chart, BTC/USD is seen on a downward move and the coin may continue to depreciate if the $31,000 support is broken. However, the 9-day moving average is seen moving below the 21-day moving average, Meanwhile, BTC/USD may likely fall and reach the critical supports at $29,500, $27,500, and $25,500 respectively.

In addition, if the bulls can regroup and energize the market, BTC/USD may likely cross above the moving averages to reach the potential resistance at $35,500, $37,500, and $39,500 levels. The technical indicator RSI (14) is moving above the 40-level, crossing below this barrier may increase the bearish momentum.