Bitcoin and Ether Rallies Push Crypto Market Cap Past $1 Trillion

The cryptocurrency market continues to rack up new milestones. This time, it’s hitting a market peak reserved for some of the world’s largest companies.

Bitcoin and Ethereum Rally

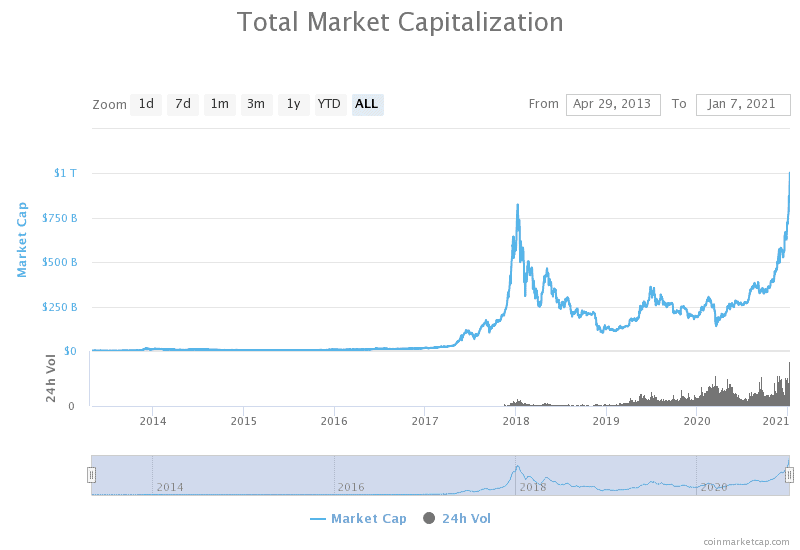

On Tuesday, Bitcoin broke the $37,000 price, taking the total market capitalization of cryptocurrencies above 1 trillion for the first time. At press time, the market cap is still above $1 trillion. The crypto market joins the likes of Apple and Amazon in the trillion-dollar club.

This is a record high for a market that has suffered ridicule from regulators and heavyweight investors over the years. This is not unexpected as Bitcoin’s market cap has doubled over the last few weeks. BTC’s market cap has broken the ceiling, smashing through new all-time highs before settling at $687.4 billion at $36,600, at press time.

Along with Bitcoin, Ethereum has combined to lead the market rally, breaking through $1,000 for the first time in almost three years. Ethereum currently trades at $1,190 with a market cap of $135 billion. Both assets are responsible for more than two-thirds of the market. Beyond their growing market caps, BTC and Ether’s price rally has led to a gravitational pull on the market.

Other altcoins have also witnessed single and double-digit returns. The trillion-dollar capitalization lends more to the market’s legitimacy, which has witnessed an influx of capital from wall street heavyweights as investors move to shield their funds away from inflation.

Growing Investor’s Trust

As Bitcoin’s price continues to climb, there’s a growing trust in the asset that shows why this rally is different from the one in 2017. In 2017, when Bitcoin closed out the year at an all-time high of $20,000, the bull cycle was driven by individual investors and Asian whales.

At the time, BTC had not gained mainstream adoption and was seen as a risky asset for most. In 2020, the big boys came to the town with their fat checks. Large fintech companies like Square and PayPal showed their support for the crypto market by investing and opening up support for trading on their platforms. The financial media hasn’t been left out either. The mainstream media has been following Bitcoin with a keen eye.

They are not dismissive as they were in 2017. Two factors are responsible for these: Bitcoin’s supply and the effect of covid-19 on businesses and economies as a whole.

Governments are being forced to increase their money supply to support the population. With the debasement of the currency comes inflation. This singular action is forcing investors to move their pile of cash into stable assets to hedge against inflation. Bitcoin’s limited supply has also played a role in its rally. The limitation in the amount of Bitcoin that can ever be produced has created a supply and demand imbalance that keeps driving the prices up.

Many large players (miners) are incentivized to hold on to Bitcoin due to its supply limit. As the trend continues, Bitcoin’s prices are expected to rise, which would positively affect the total crypto market cap. At press time, the total market cap of the crypto market stands at $1.03 billion.